Real-Time Risk

Management Solutions

Tools that provide real-time, low latency enterprise-wide risk management,

market awareness and control.

-

Our experience with High Frequency firms has made us familiar with the unique requirements of this space (large volumes, multiple data interfaces and exchange networks). This experience helps us make complicated requirements simple and straight forward. Give us a call and let us simplify for you.

PHD's makes Risk Management quick and affordable to implement

TRY OUR RISK SHIELD CALCULATOR BELOW

Risk Shield Calculator

Real-Time Risk Management solutions for the financial securities market

Whether you are a Prop Trading, Hedge Fund, Clearing Firm, Broker, Introducing Broker or Umbrella Firm proving capital and/or tools, PHD has risk management tools that can elevate your return as a business while decreasing your risks.

PHD Risk Shield

The Risk Shield is the complete risk management solution spanning the full trading canvas for brokers, hedge funds, sponsors, and clearing firms. Protect your business with our comprehensive suite of risk management tools or pick and choose from our tools to customize your own risk solution or simply fill in the gaps to enhance your current solution. Monitor and manage risk easily across multiple platforms and accounts with our customizable window layouts. PHD Risk Shield- providing the right products and services to meet your needs at unbeatable prices!

Complete Protection for All Your Risk Management Needs

Learn more about how PHD's Risk Shield can help protect your business:

Prop Trading-Hedge Fund Section

Additional Functionality Section

Proven Technology Currently Used by the Most Active Volume Traders in the World

Established Low-Latency Infrastructure to all US & Canadian Equities Markets, Private & Public Venues, Lit & Unlit

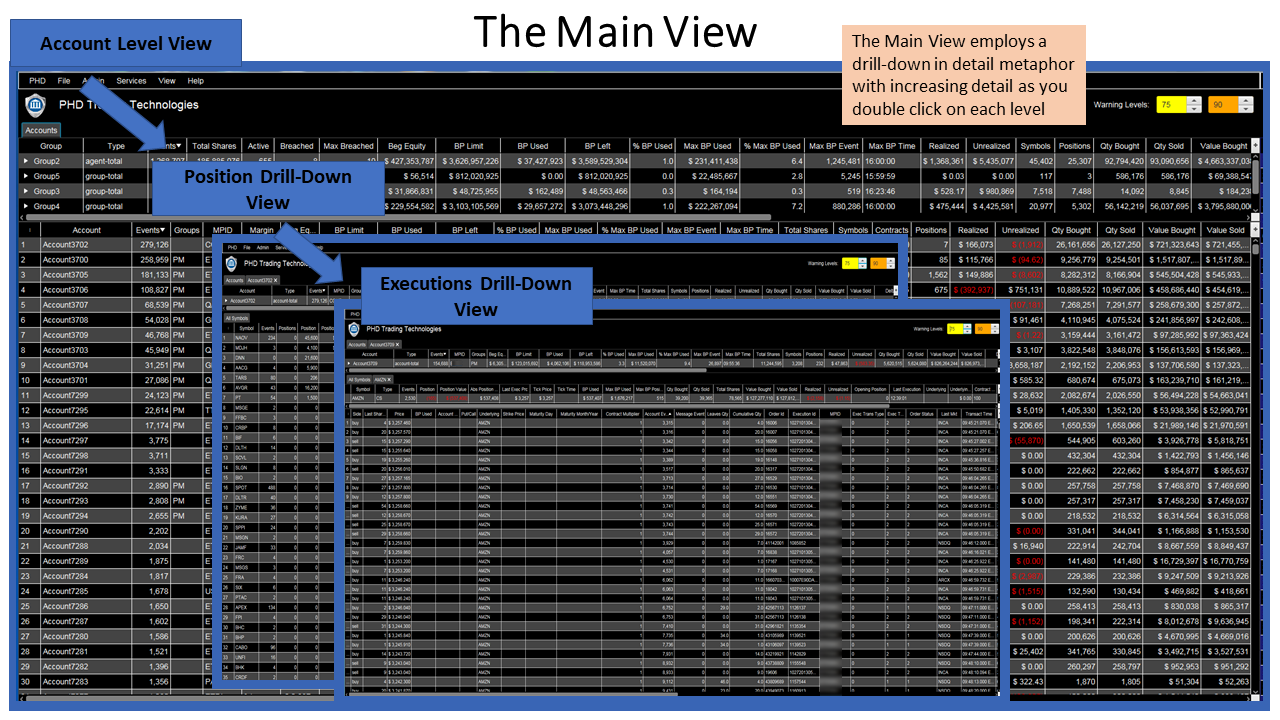

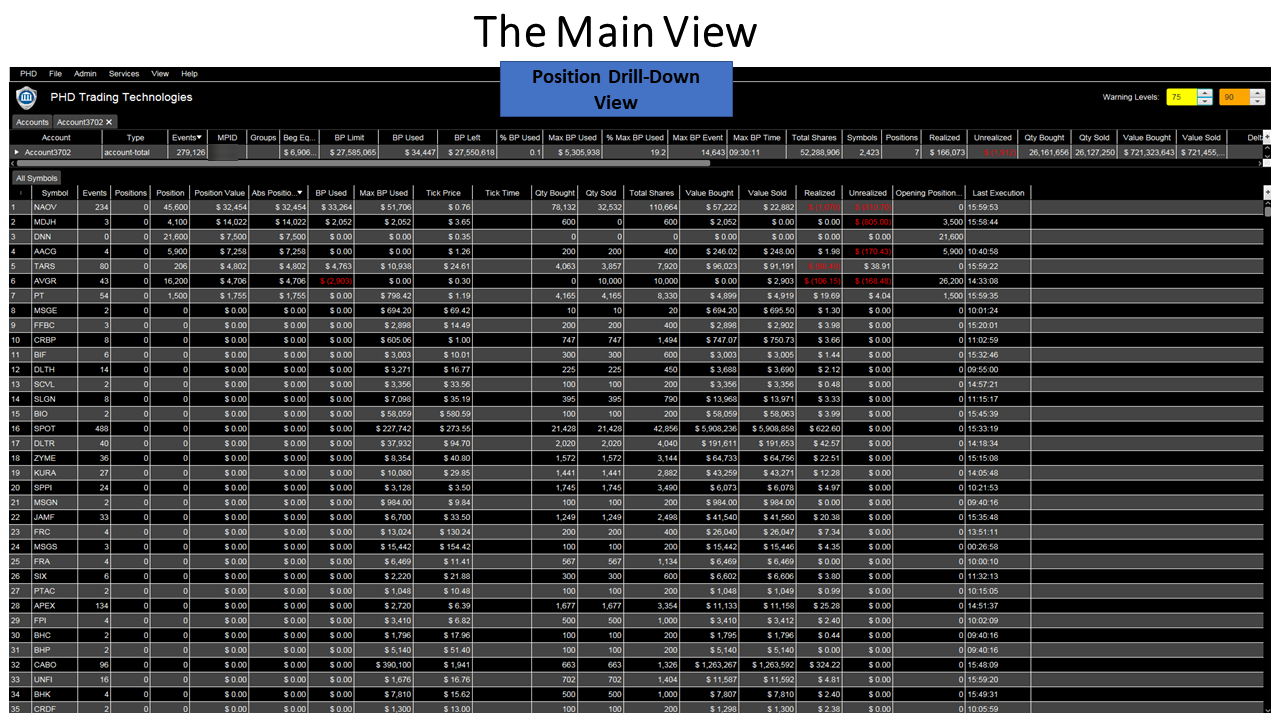

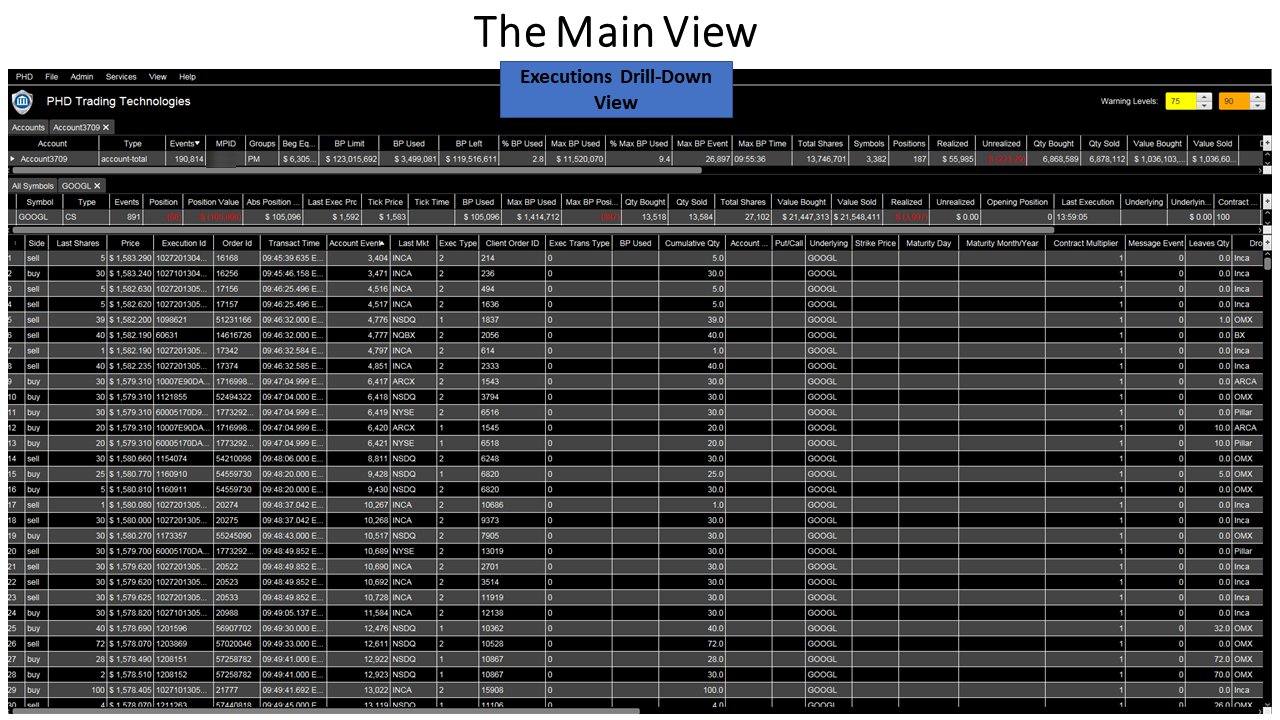

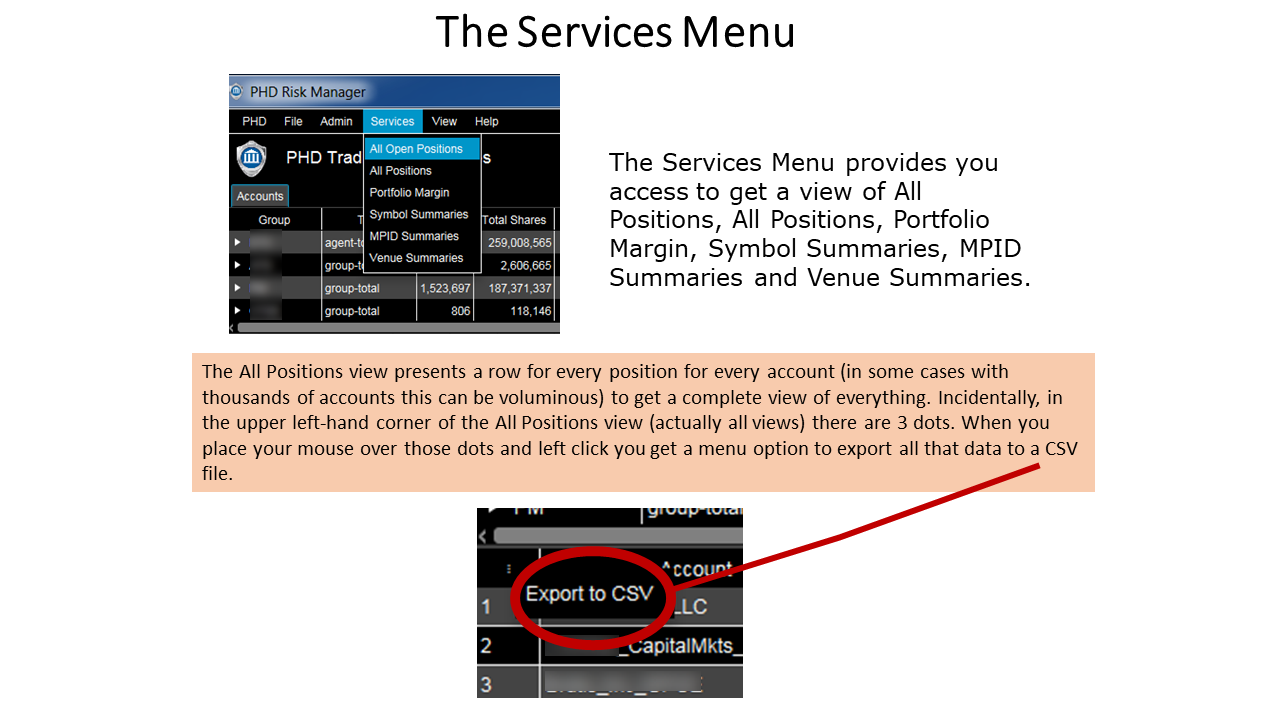

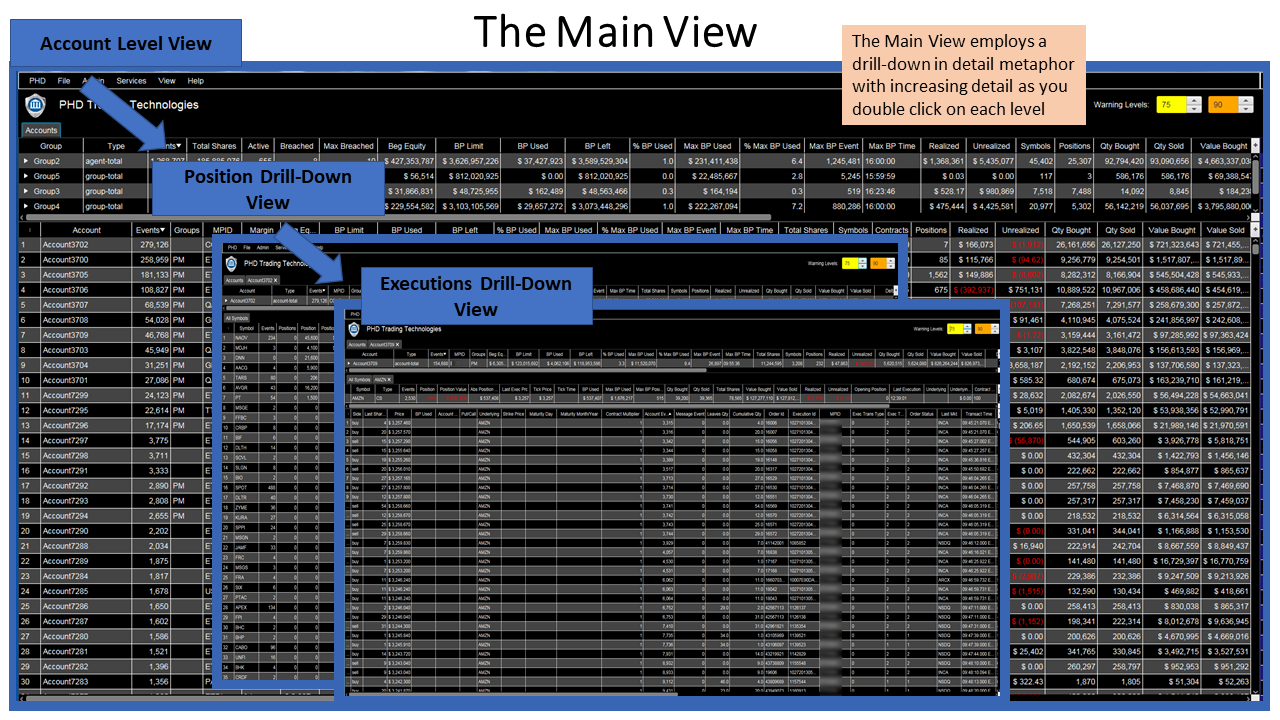

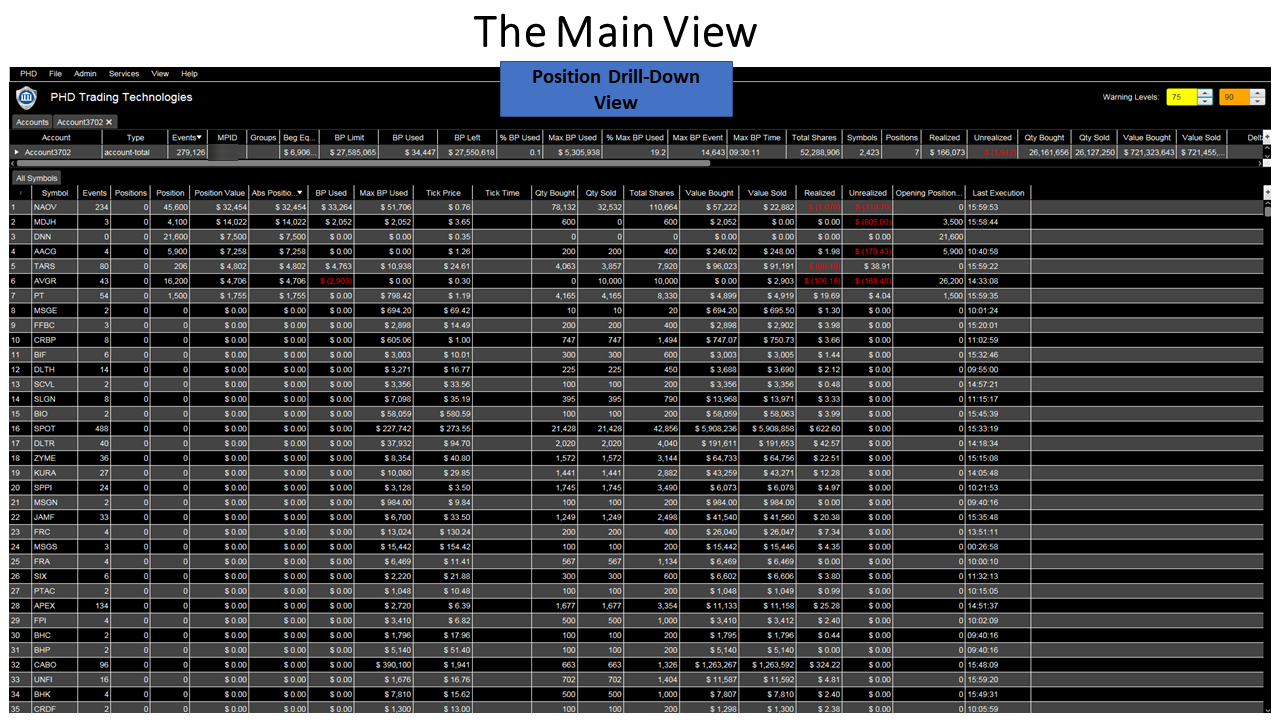

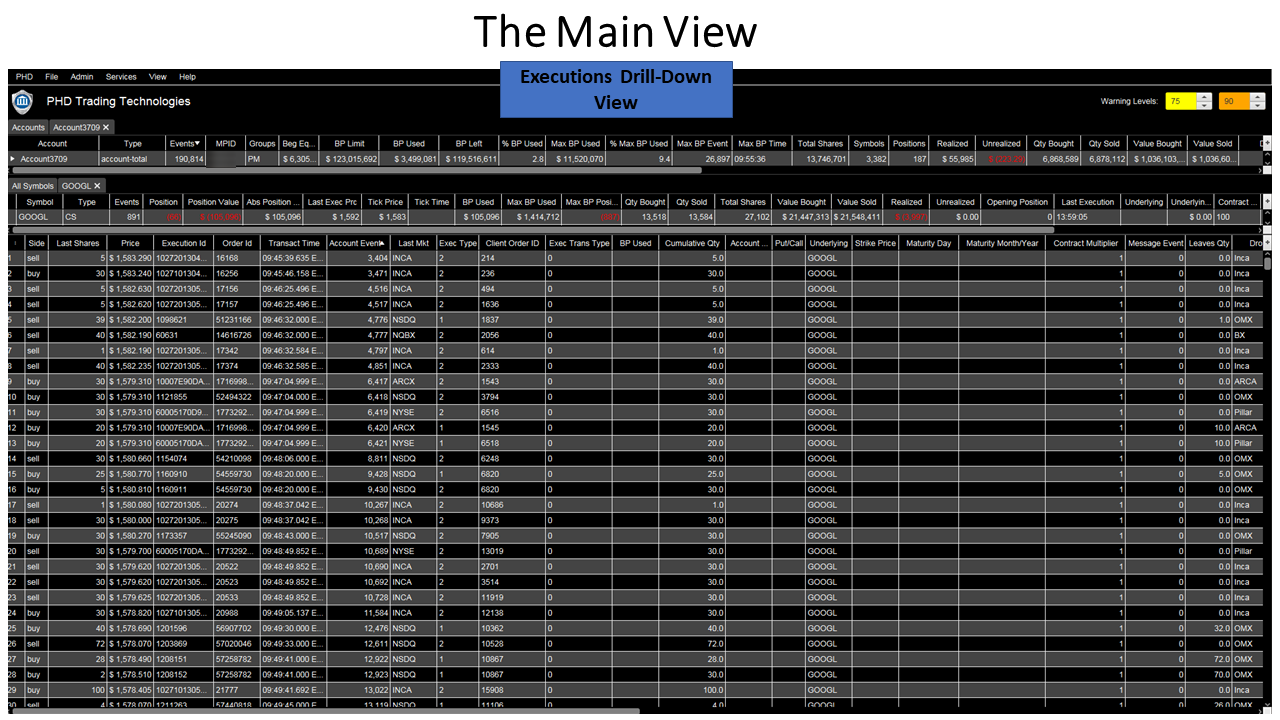

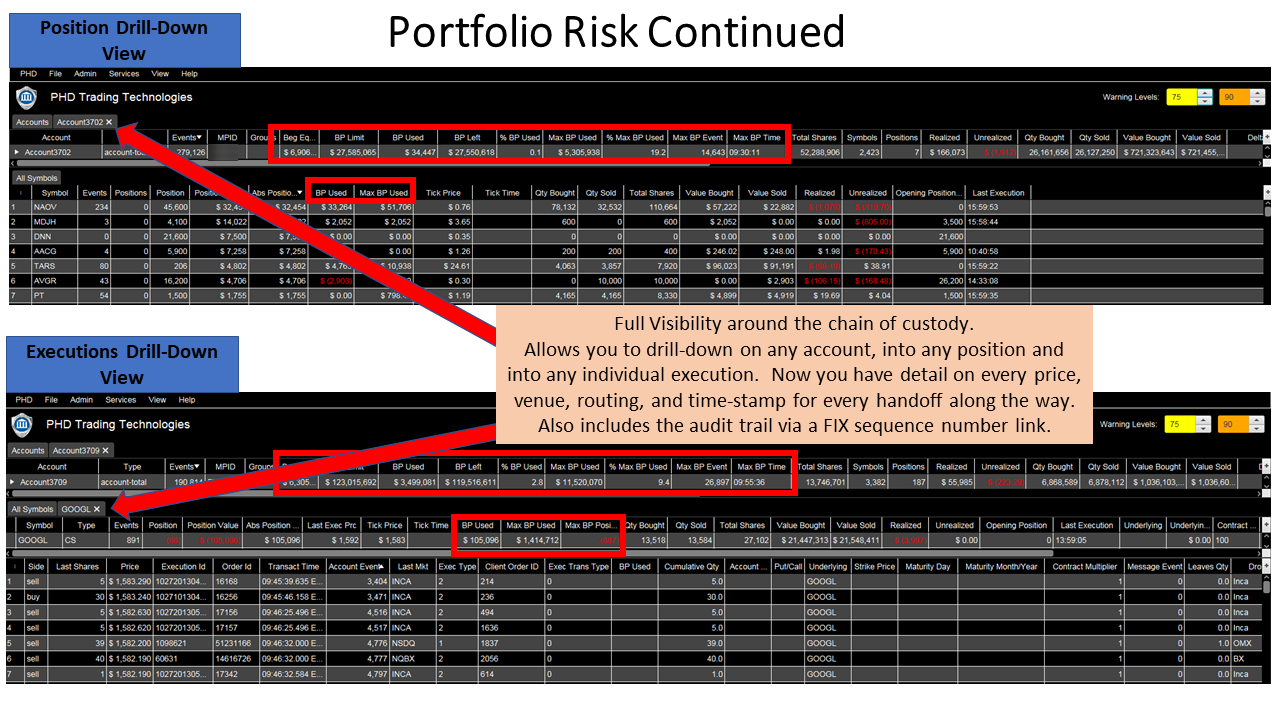

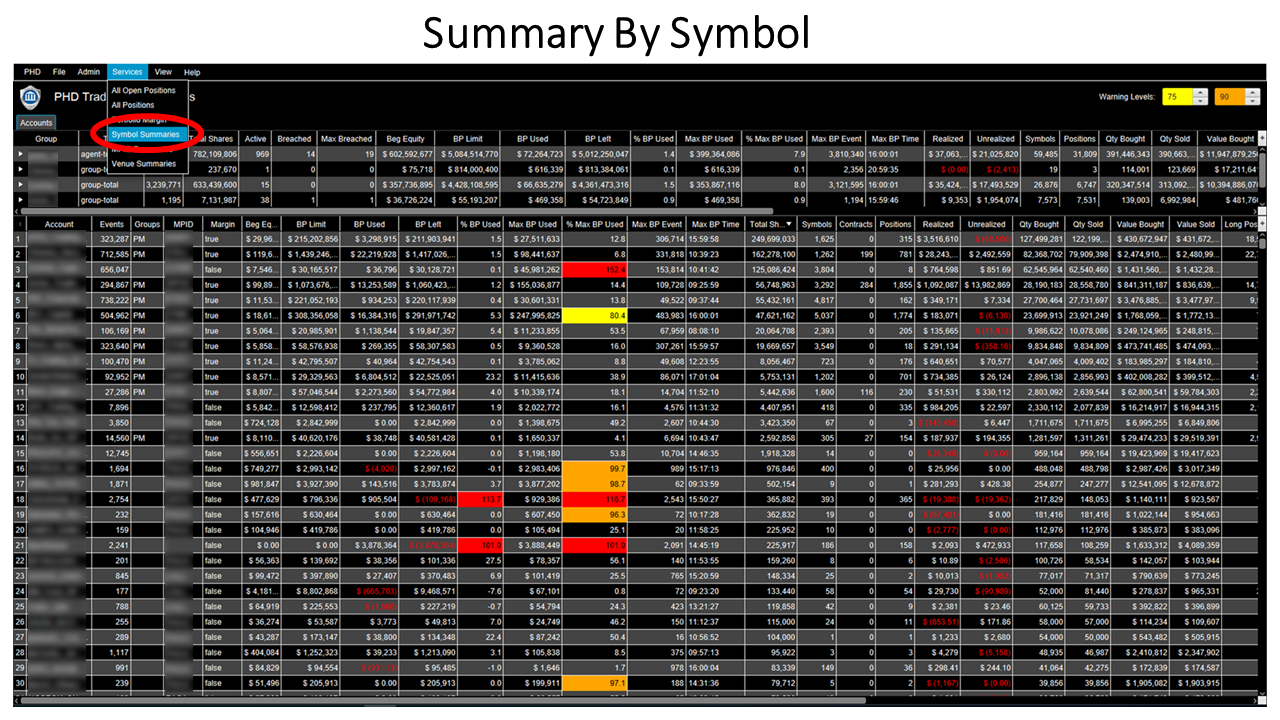

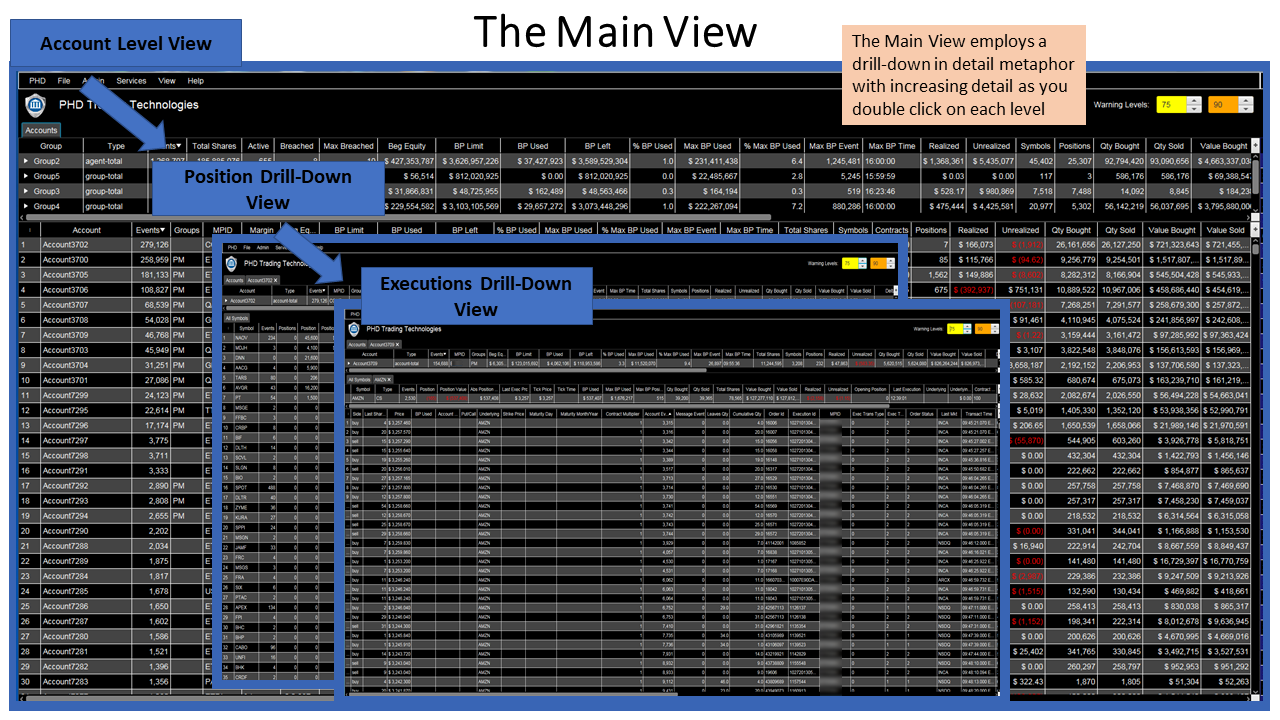

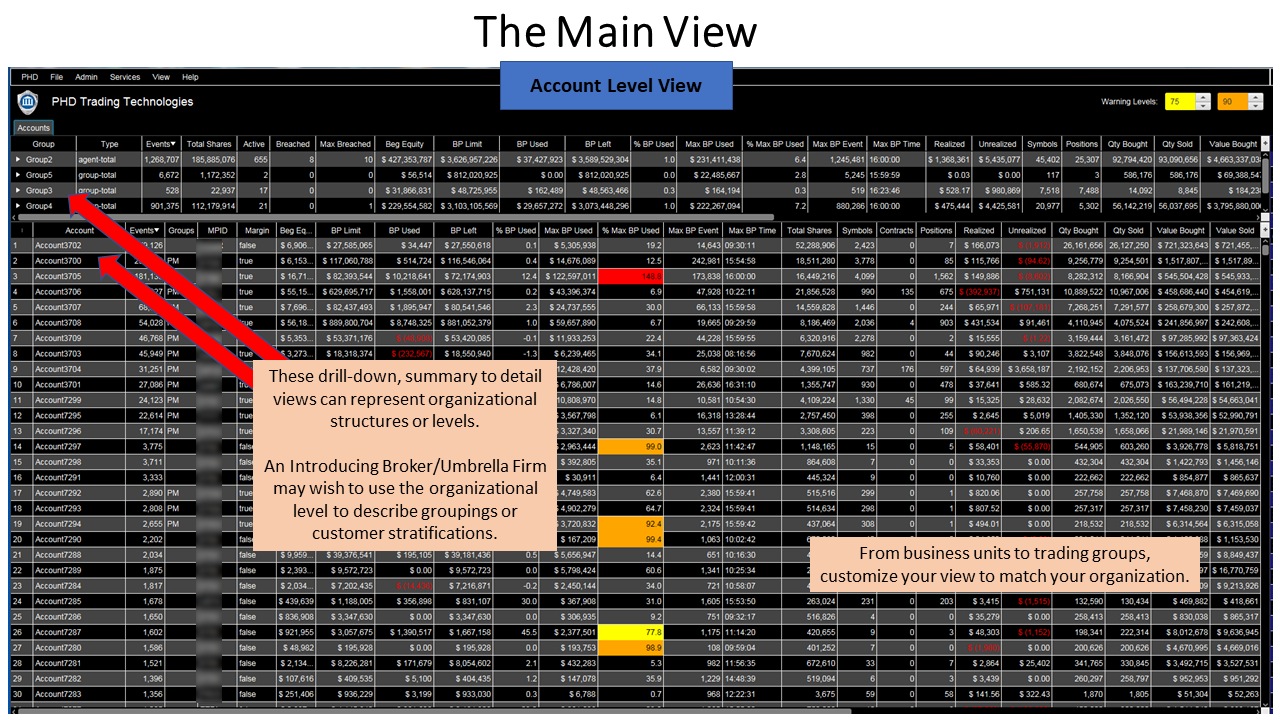

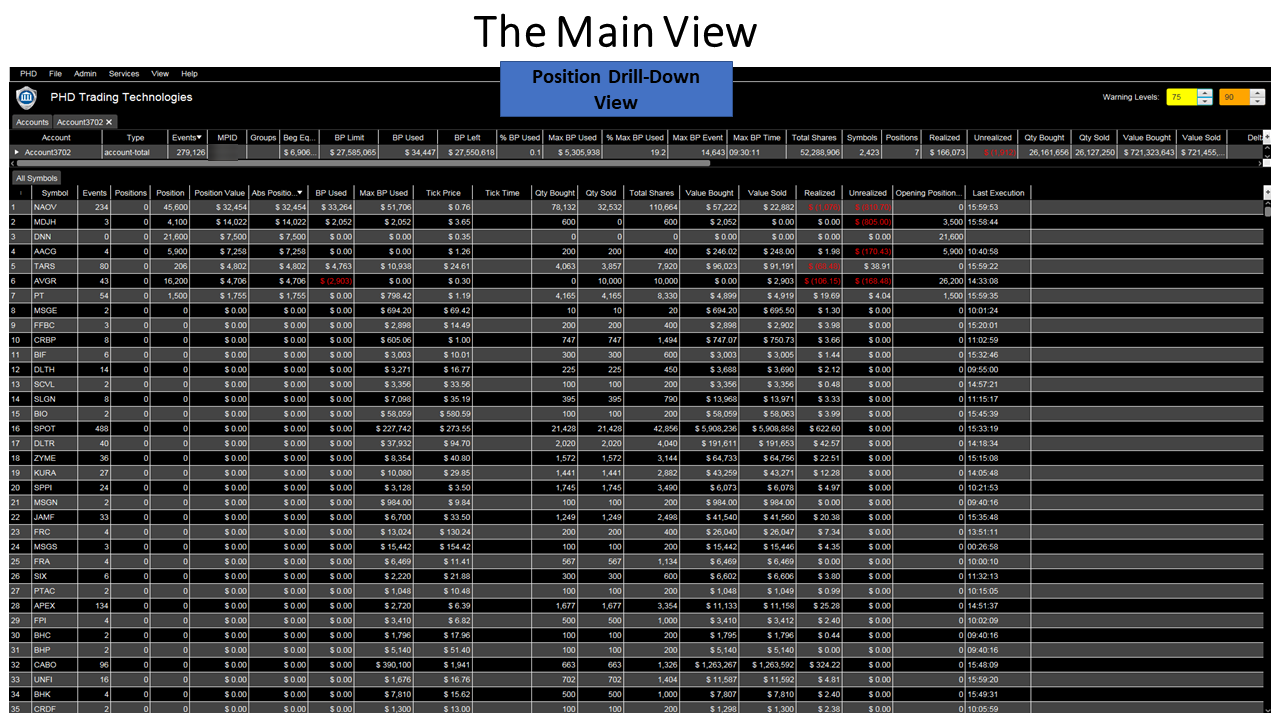

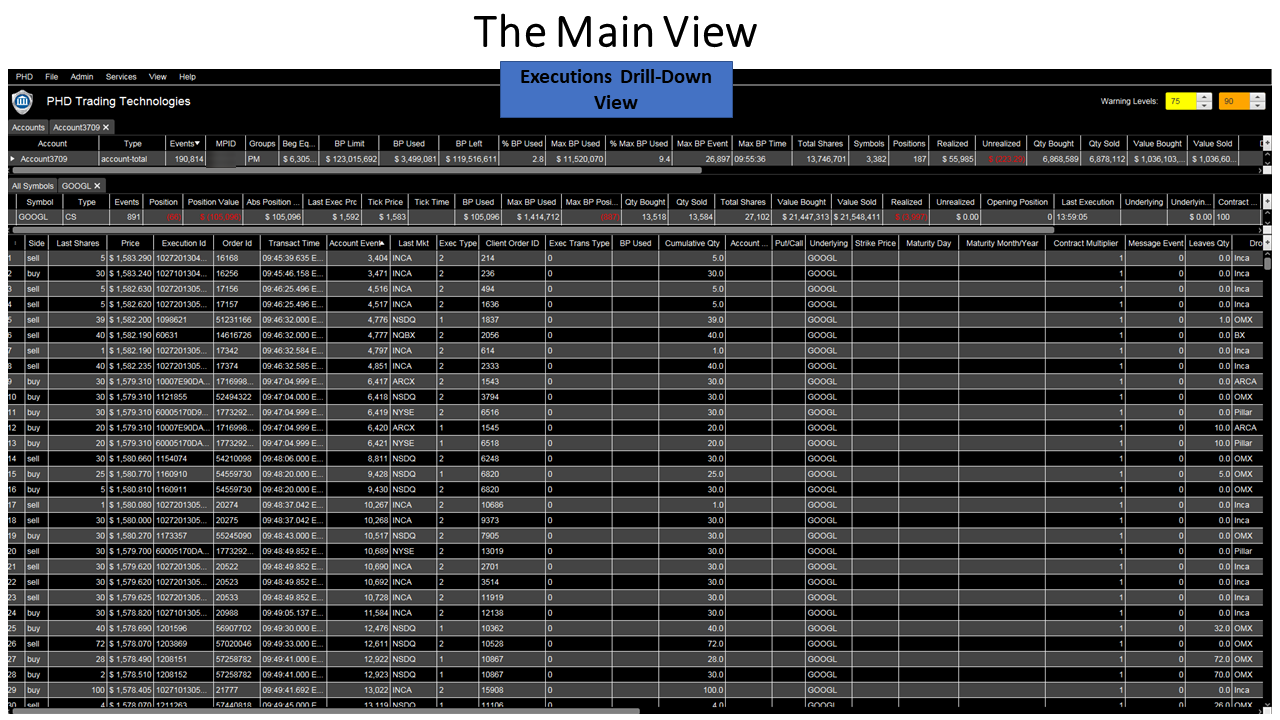

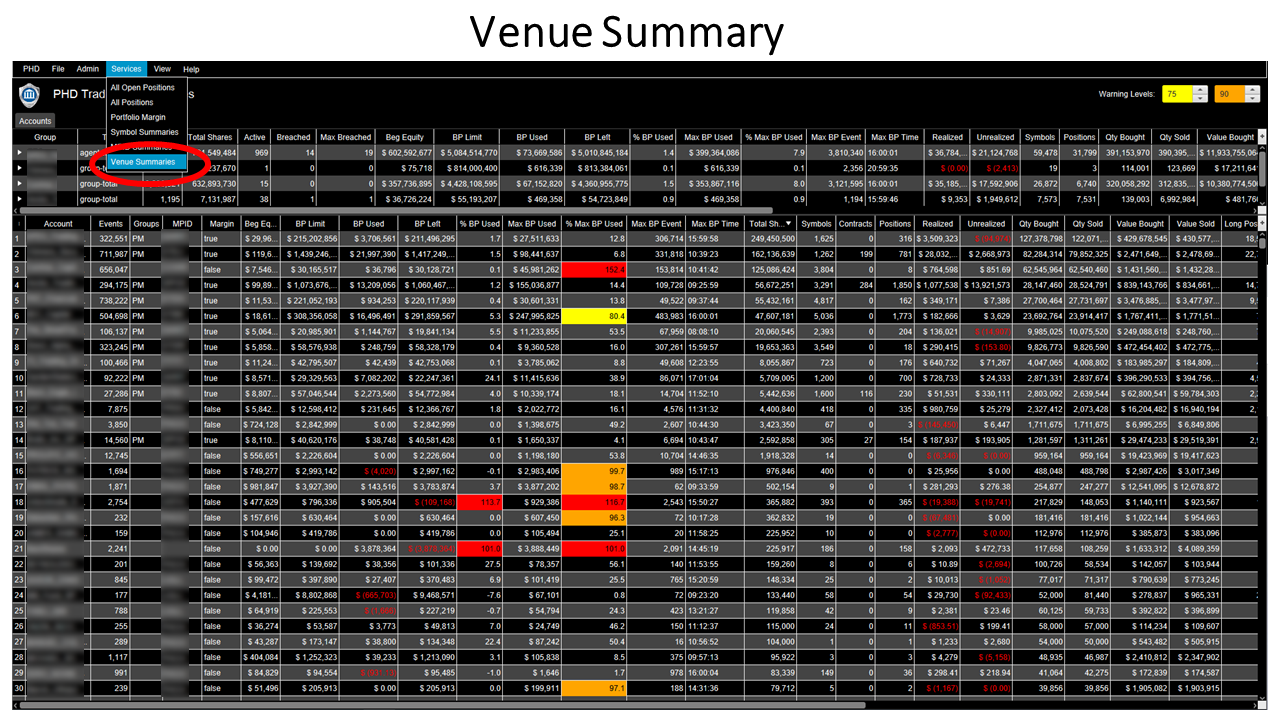

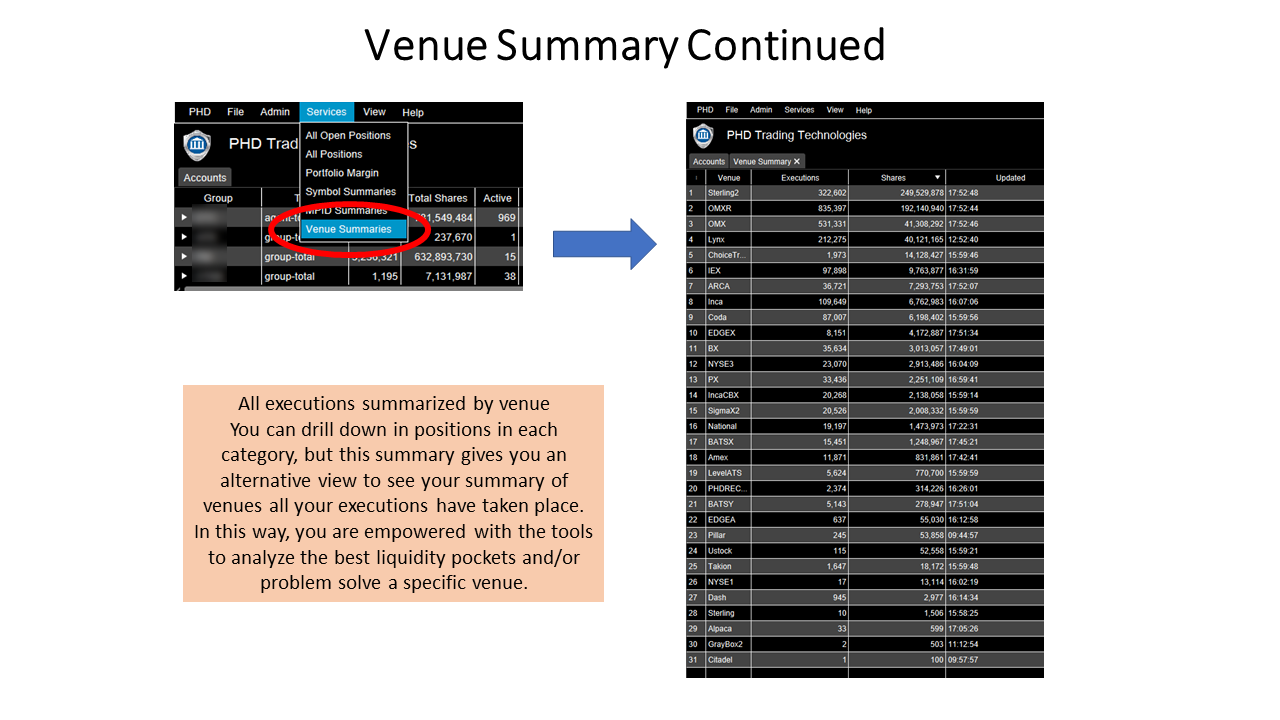

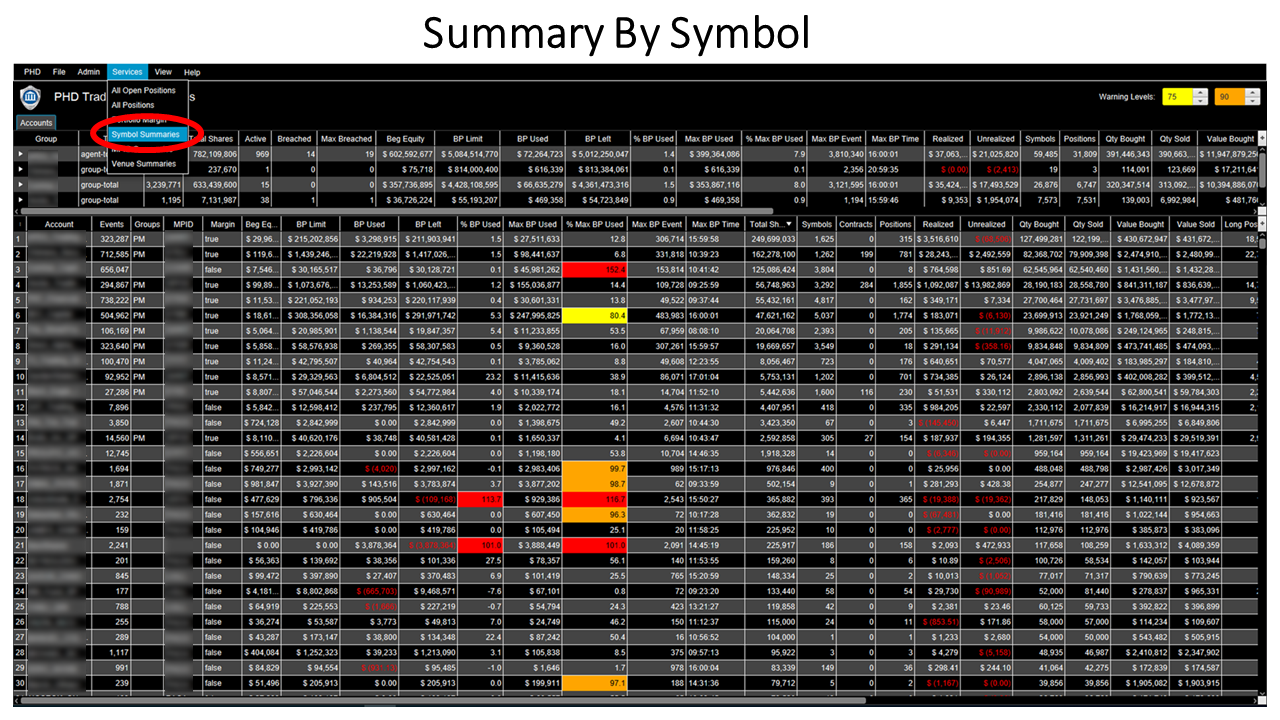

View Trade Blotter & Buying Power in Real-Time

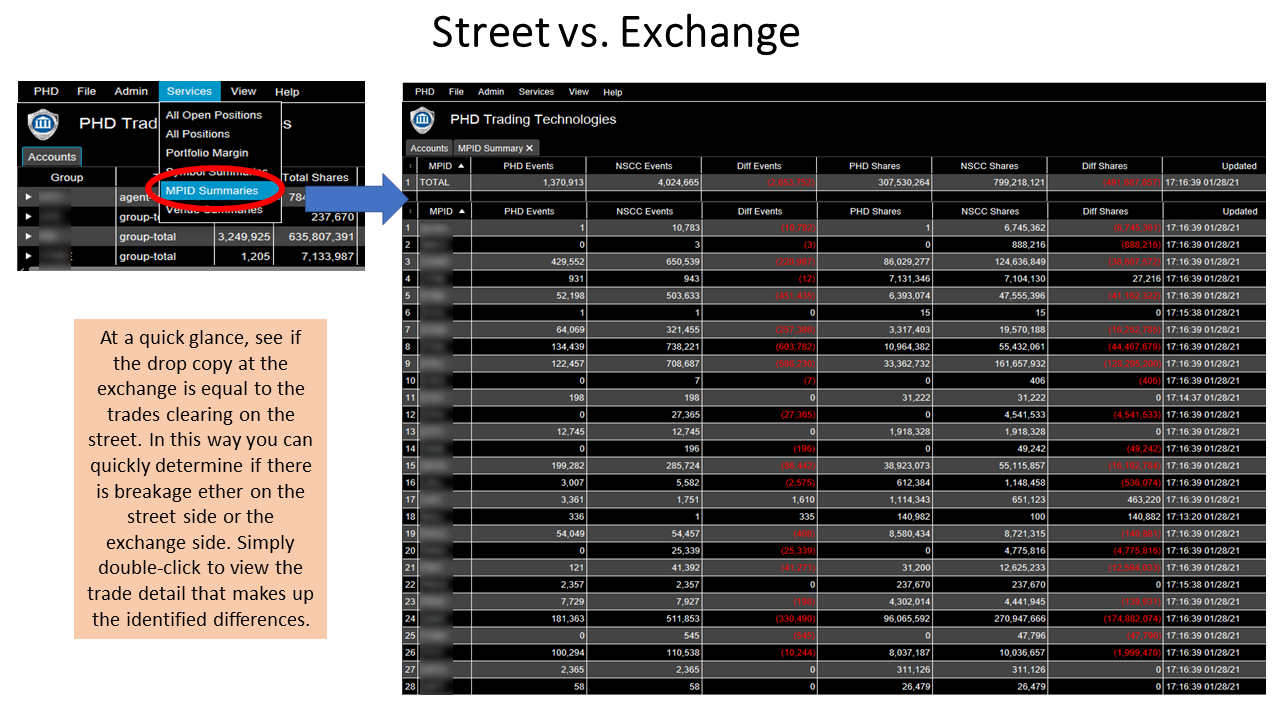

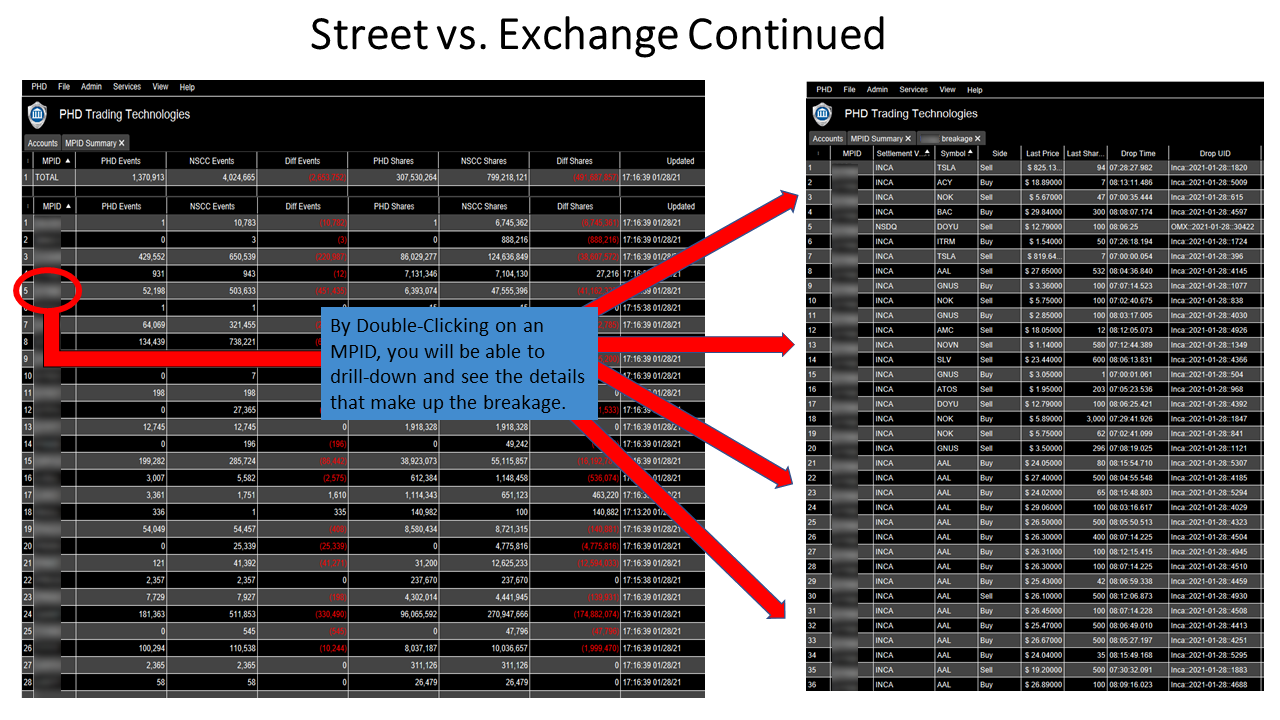

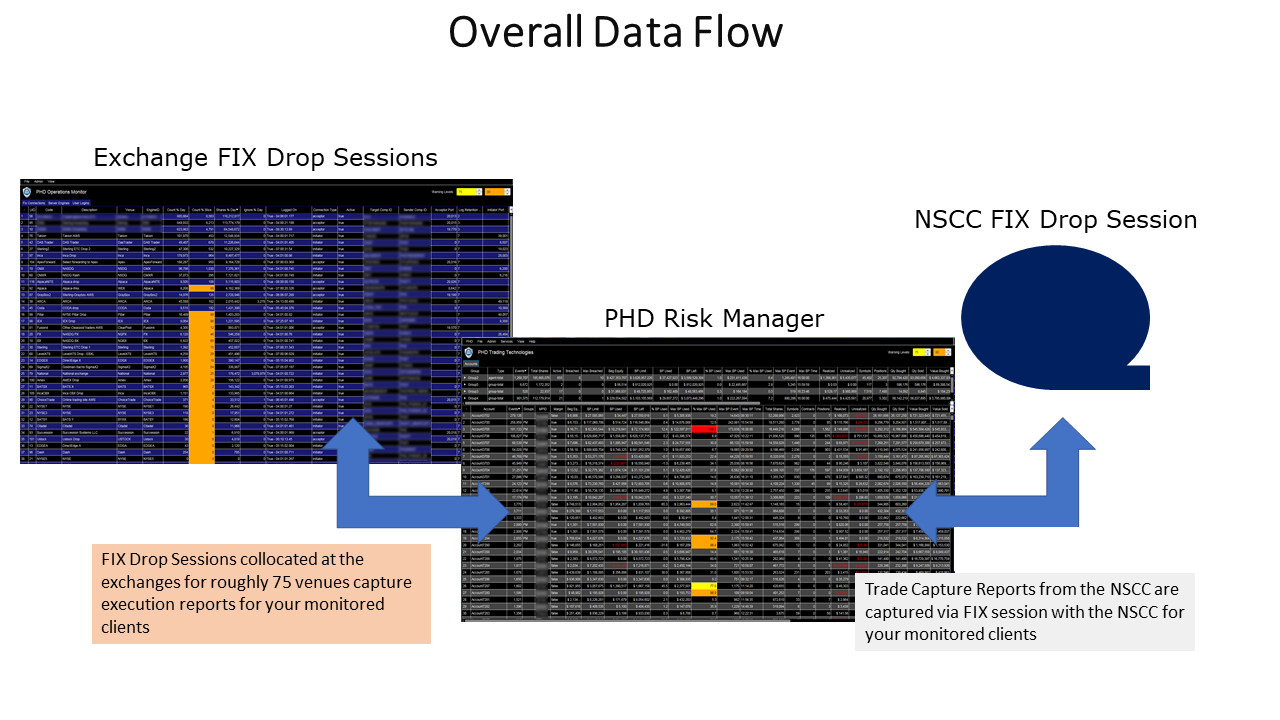

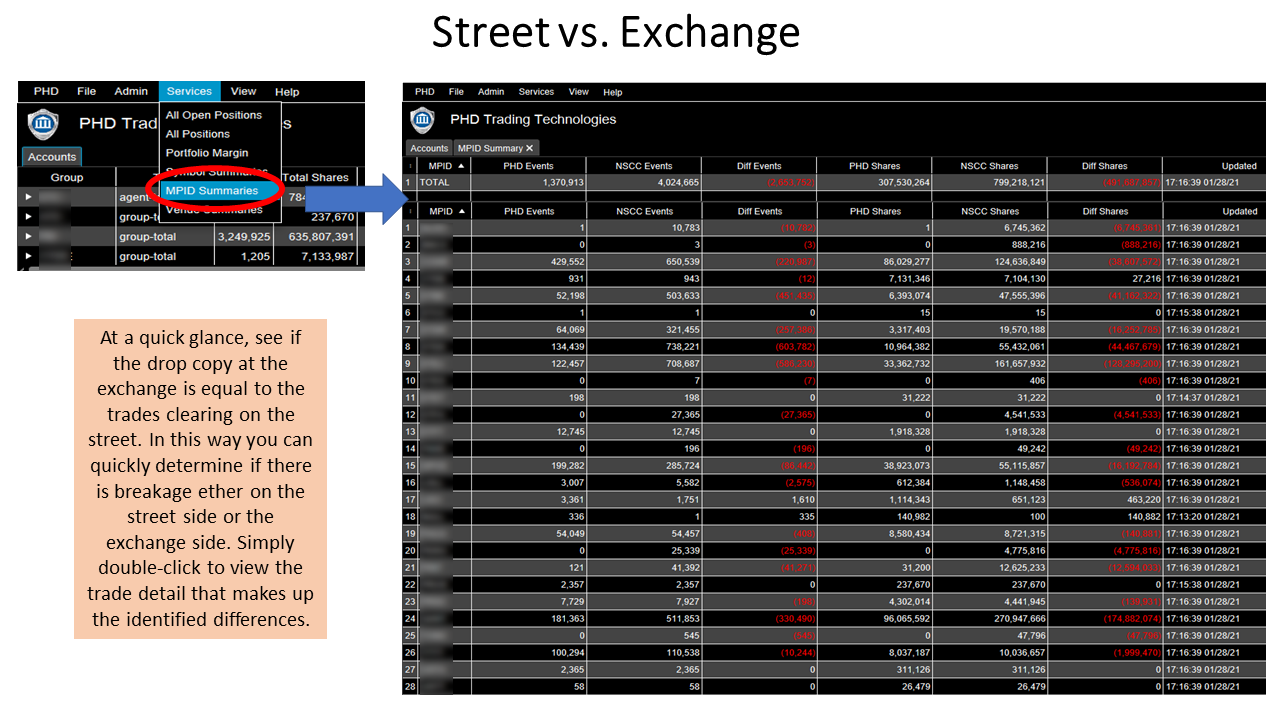

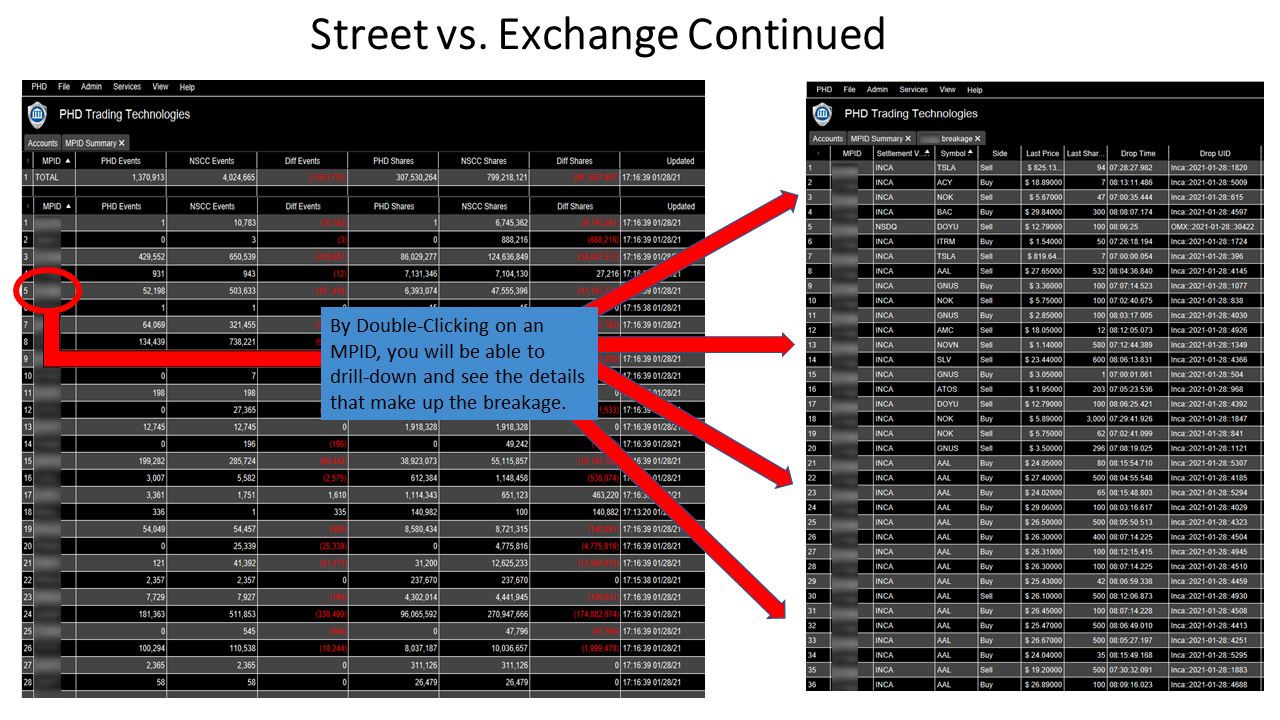

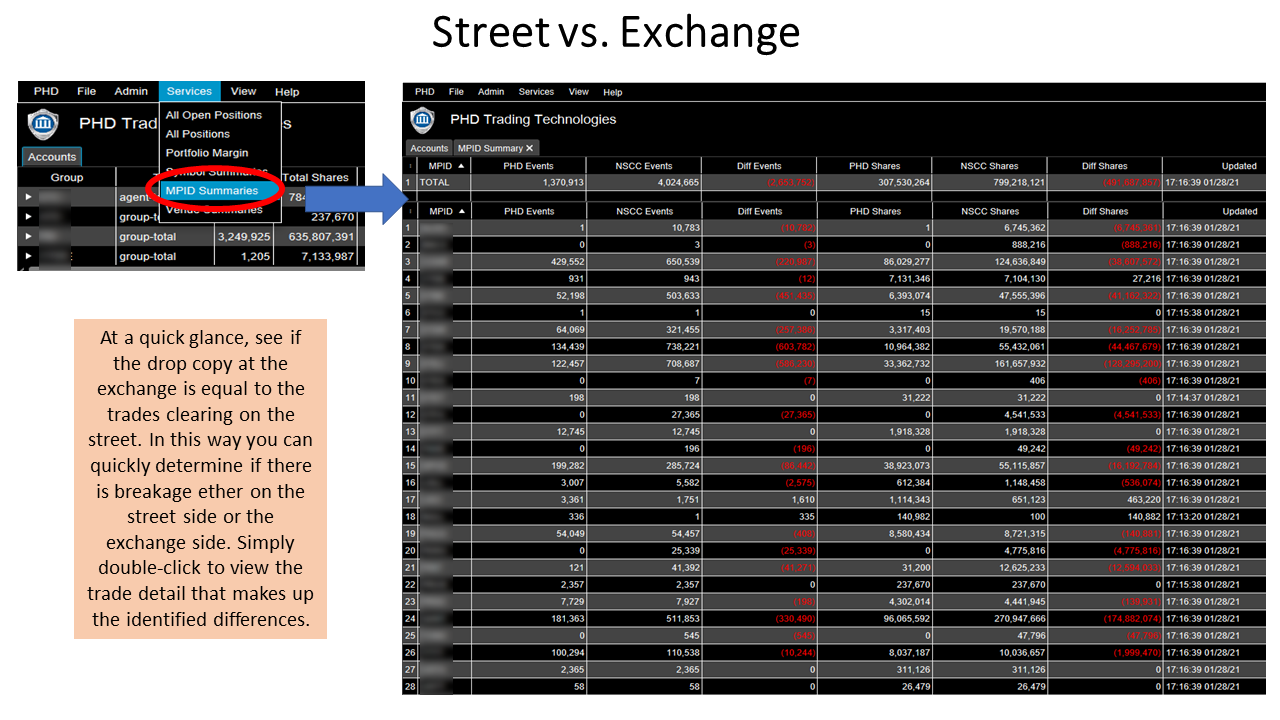

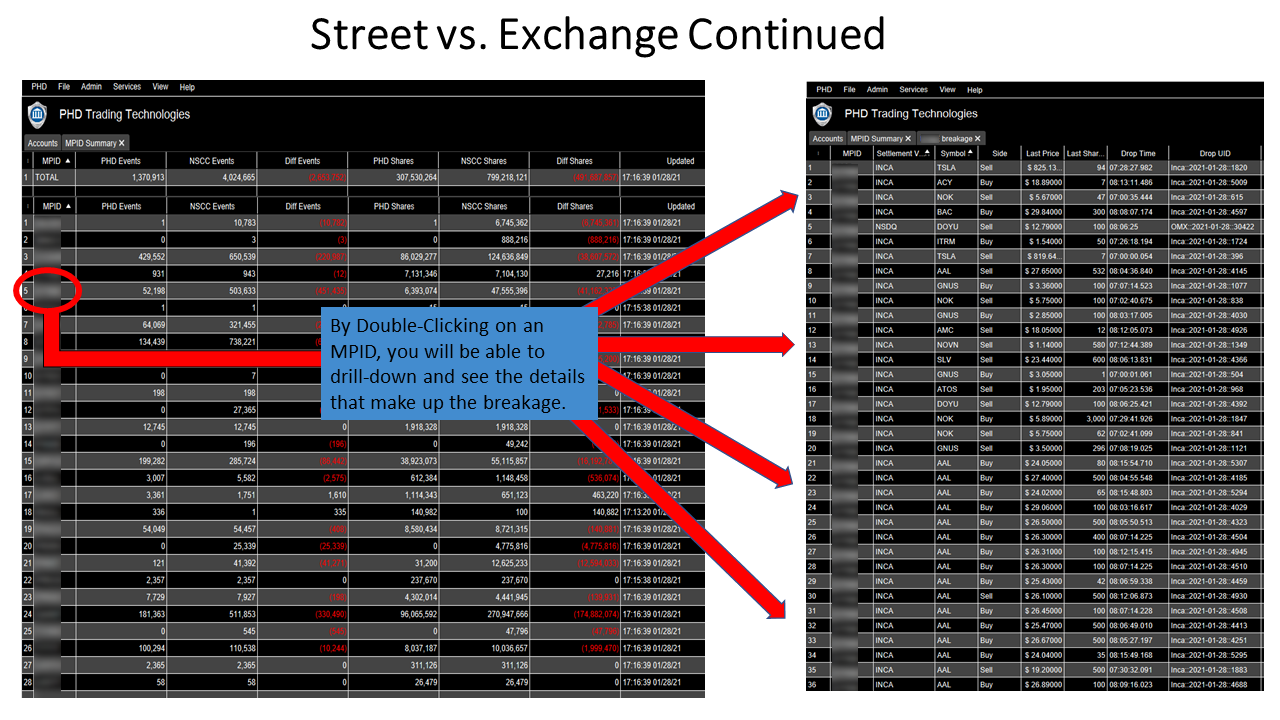

- NSCC Integration is available for Breakage

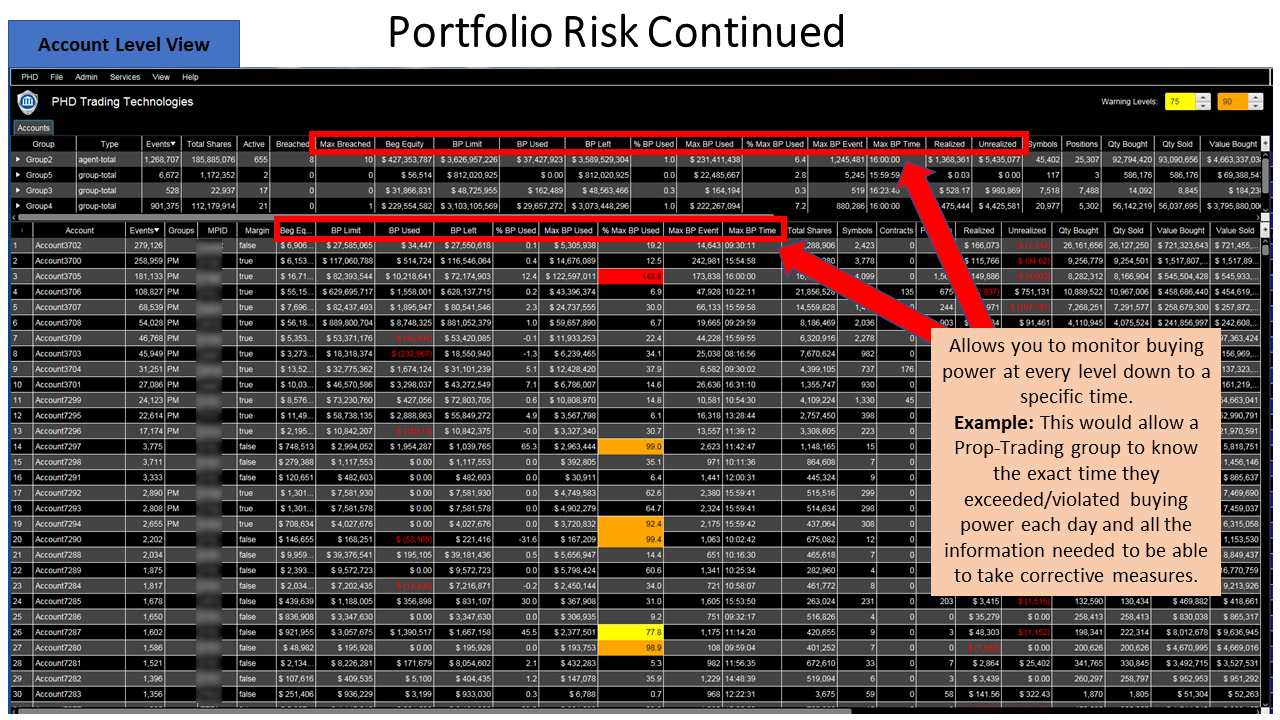

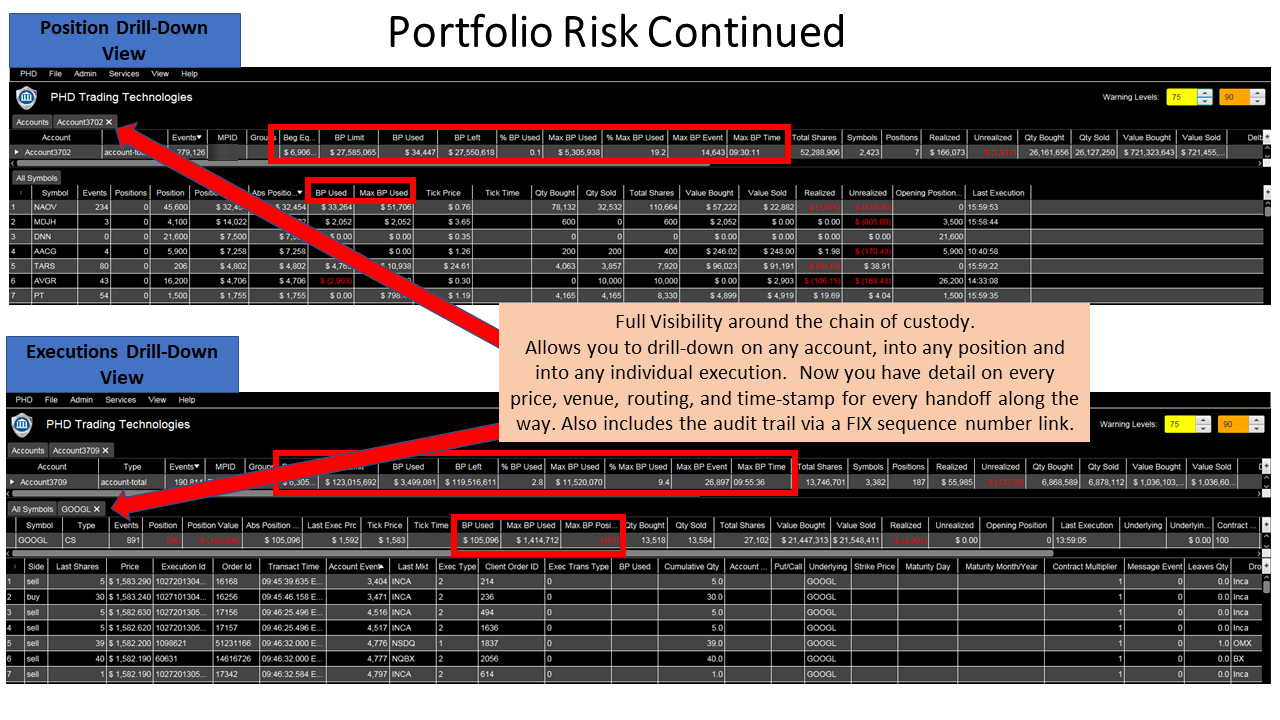

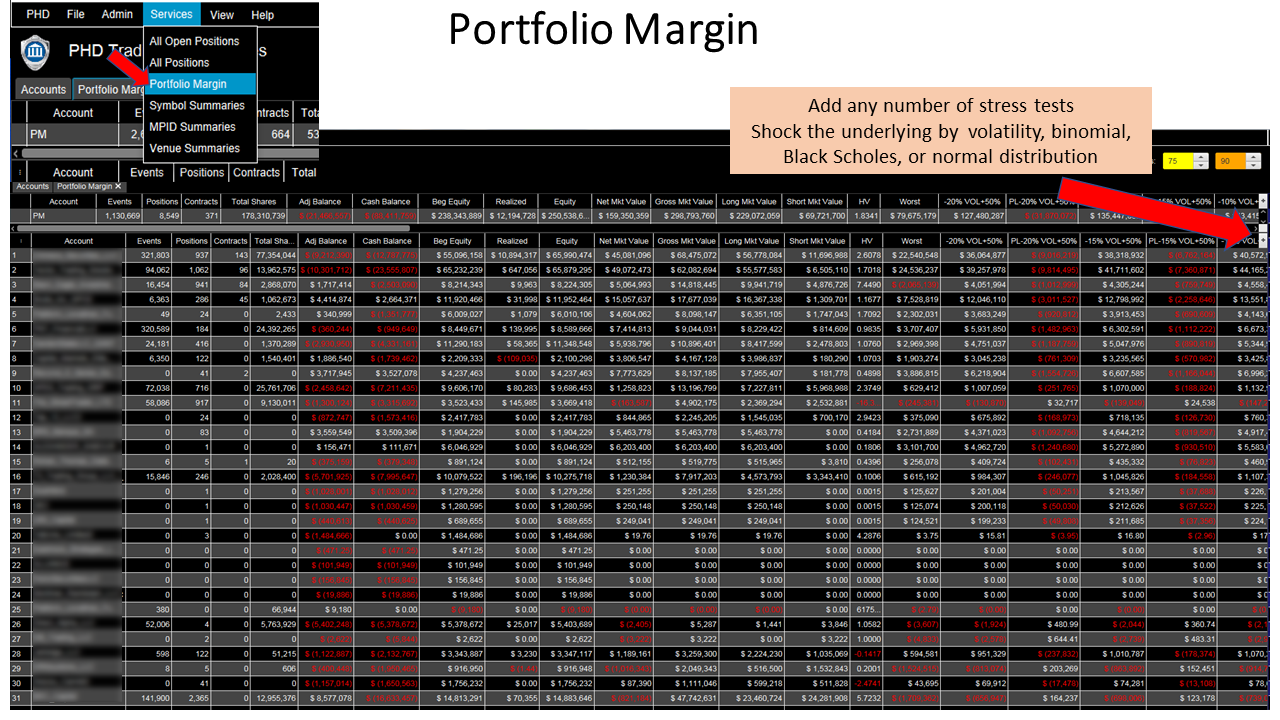

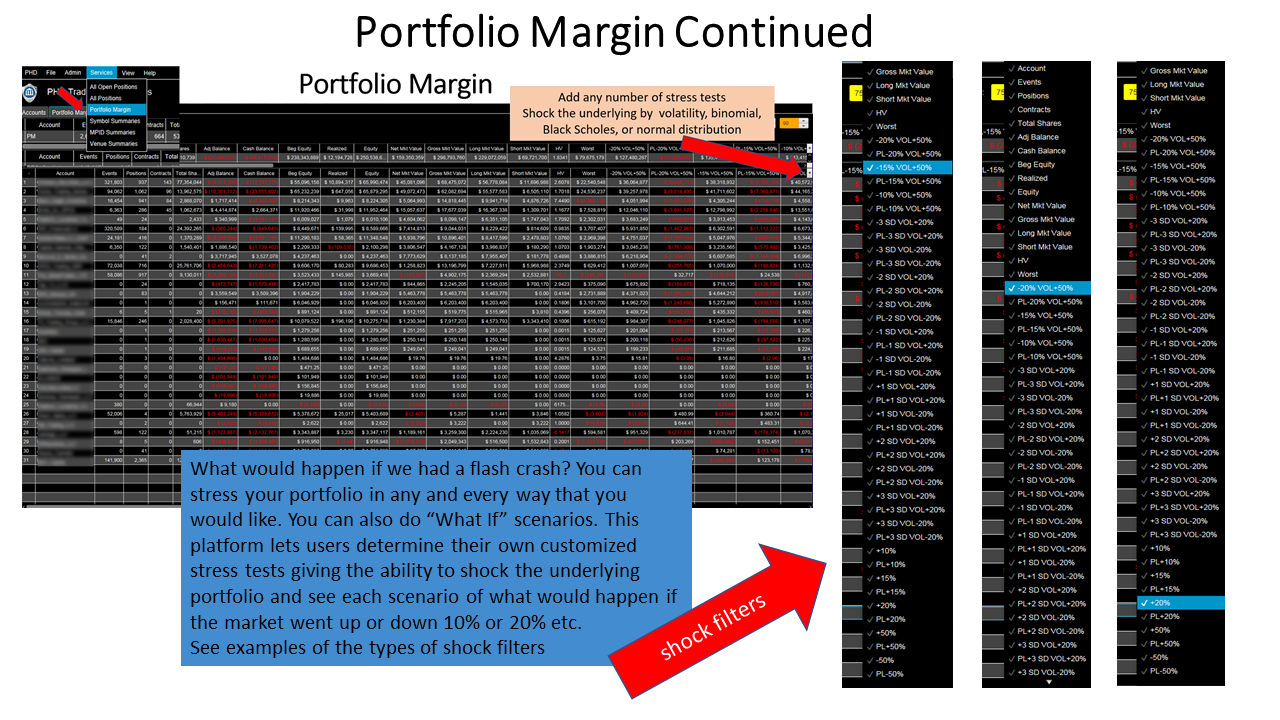

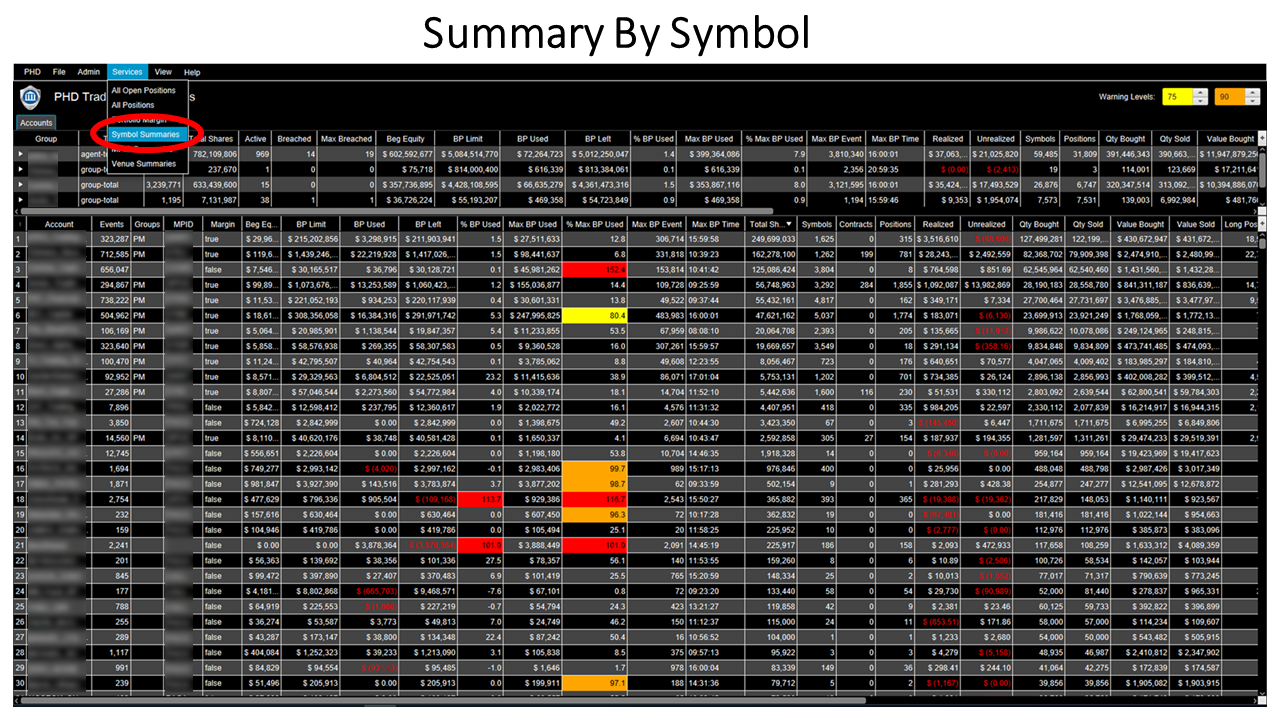

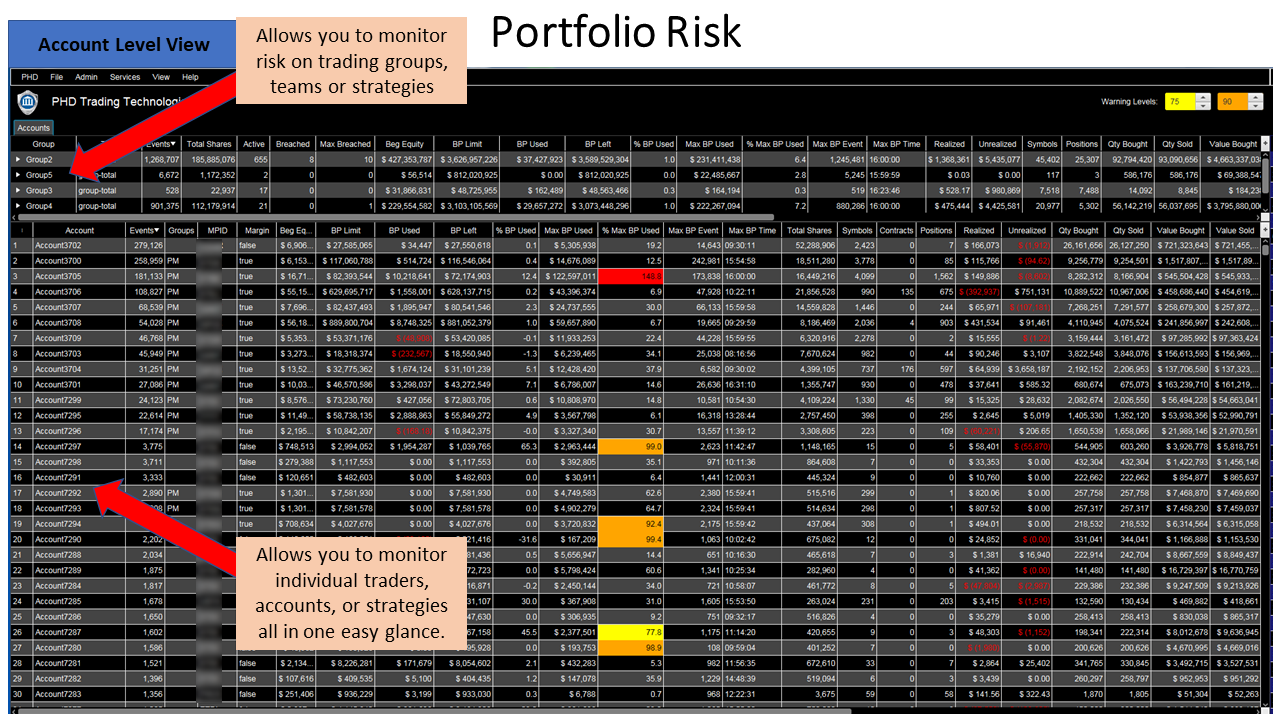

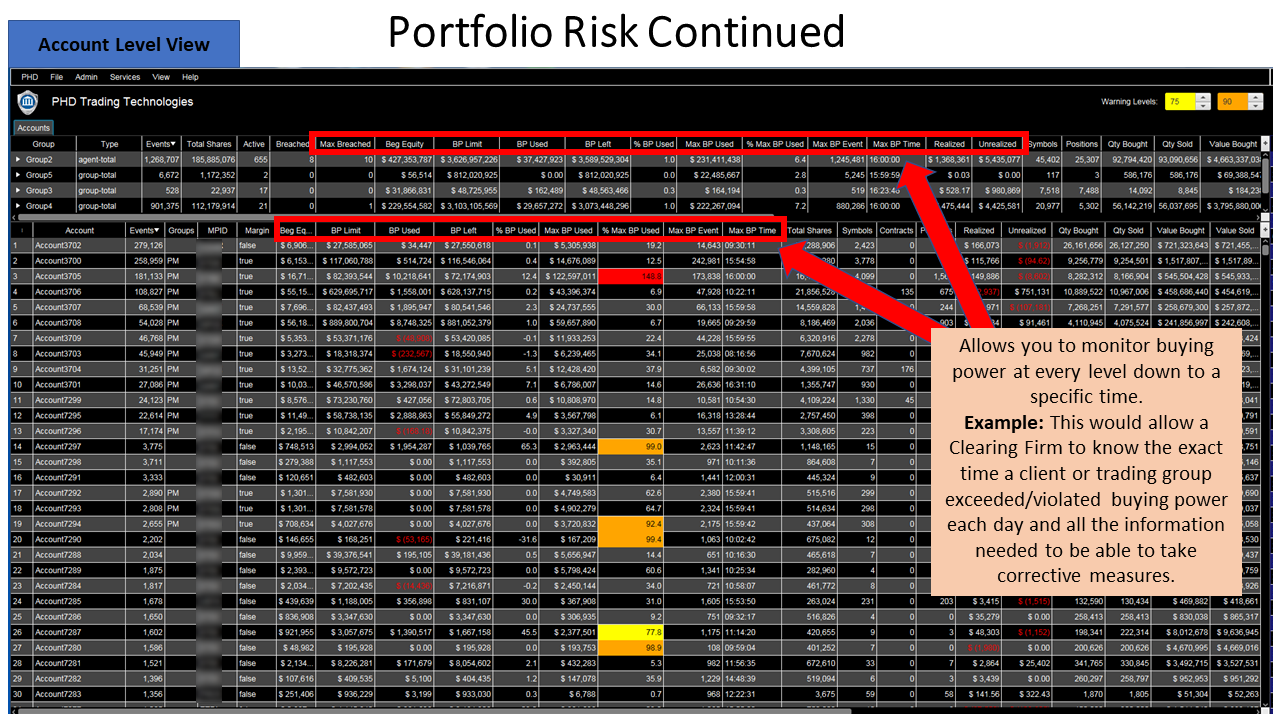

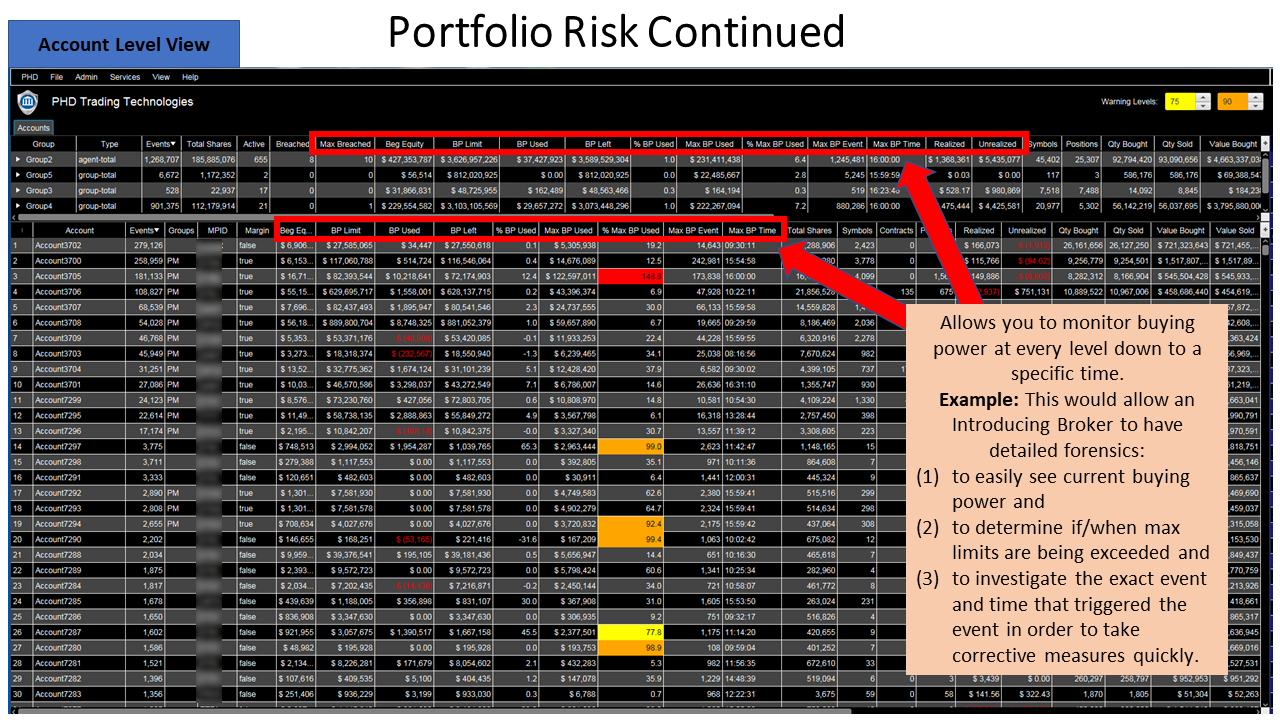

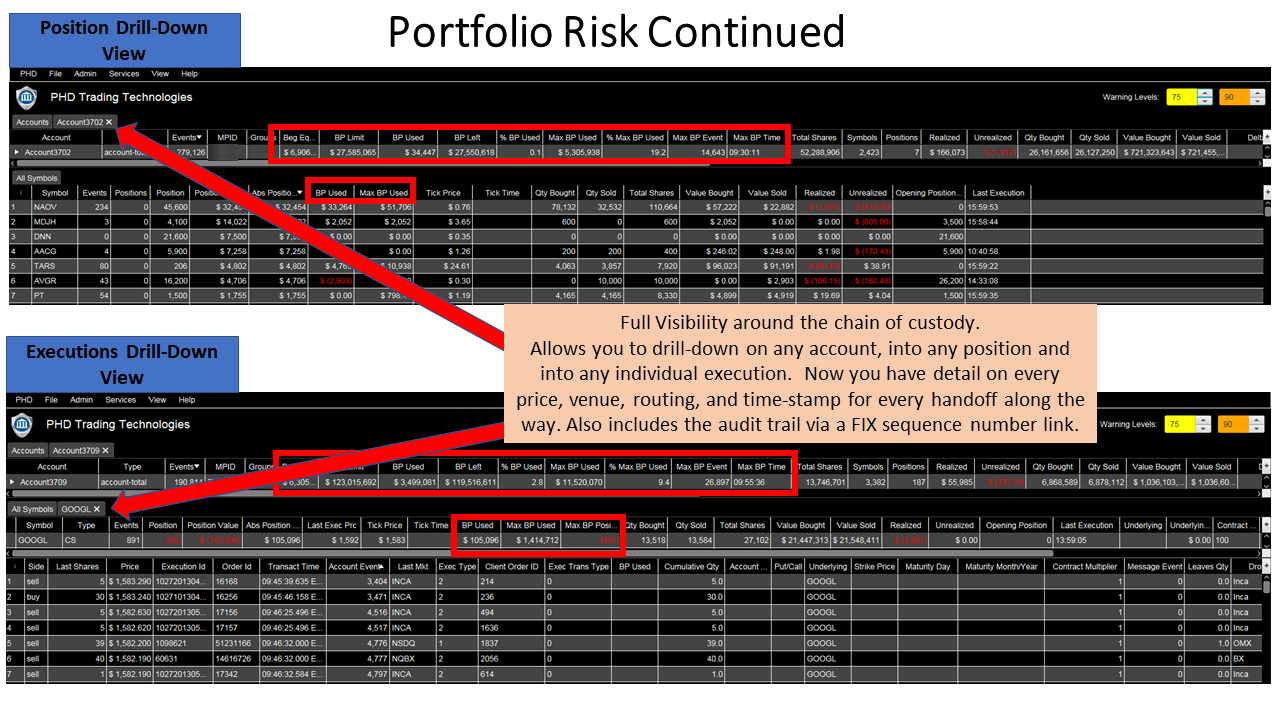

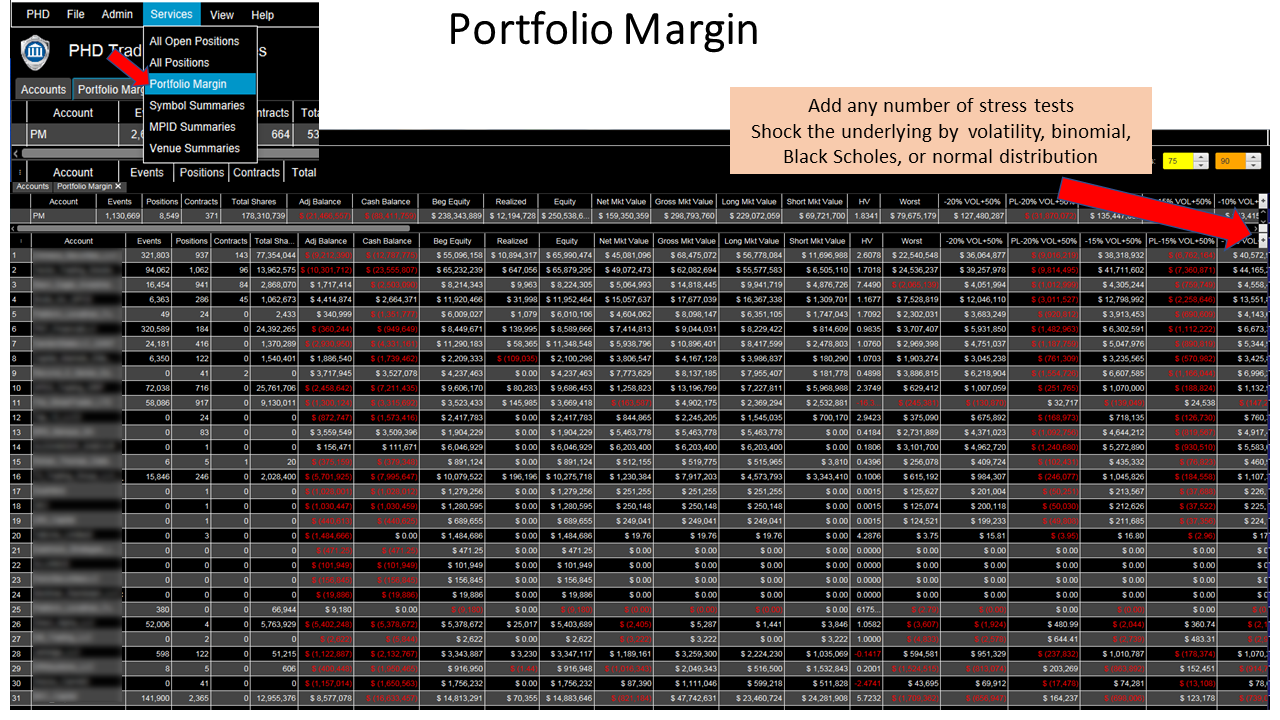

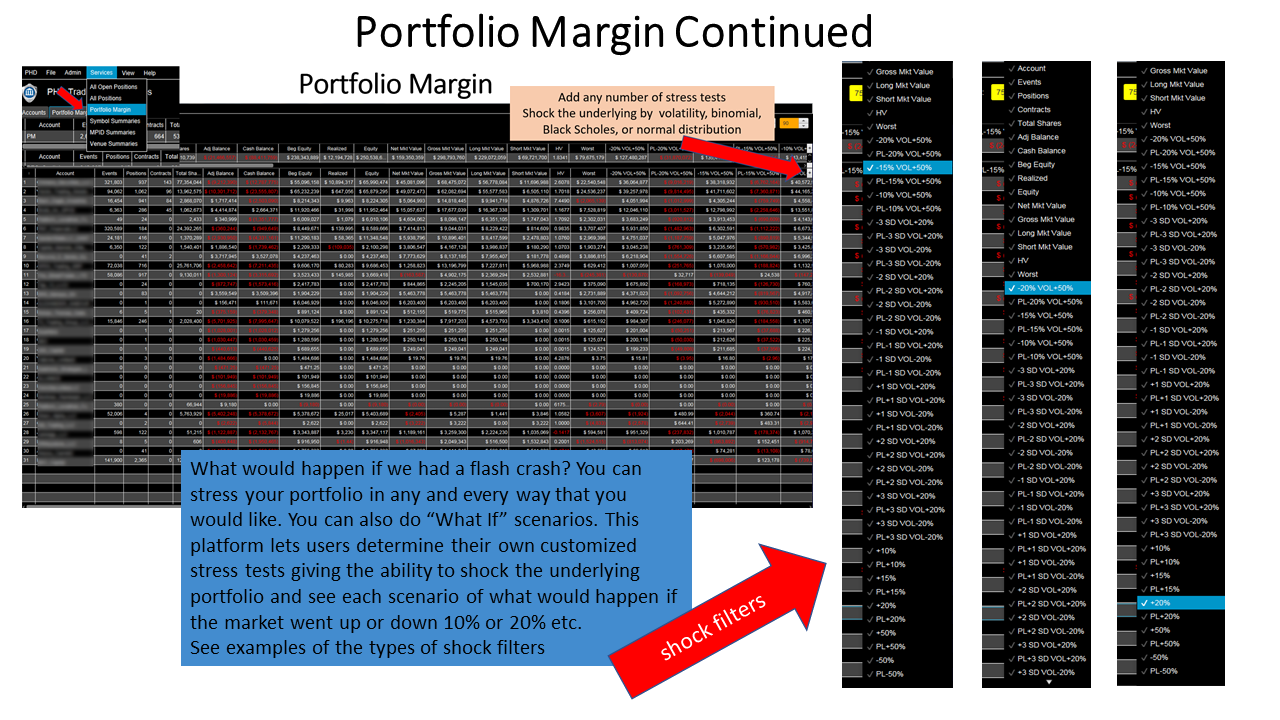

- Full Visibility & Configurable Buying Power Calculations

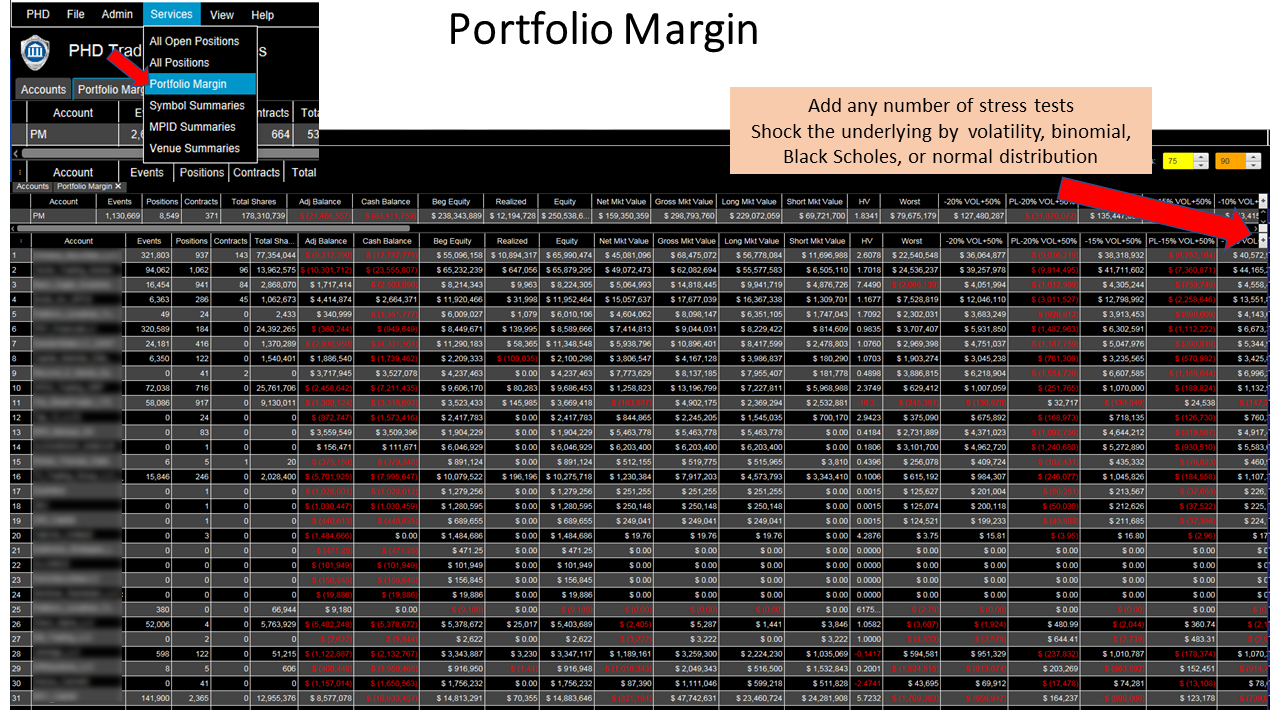

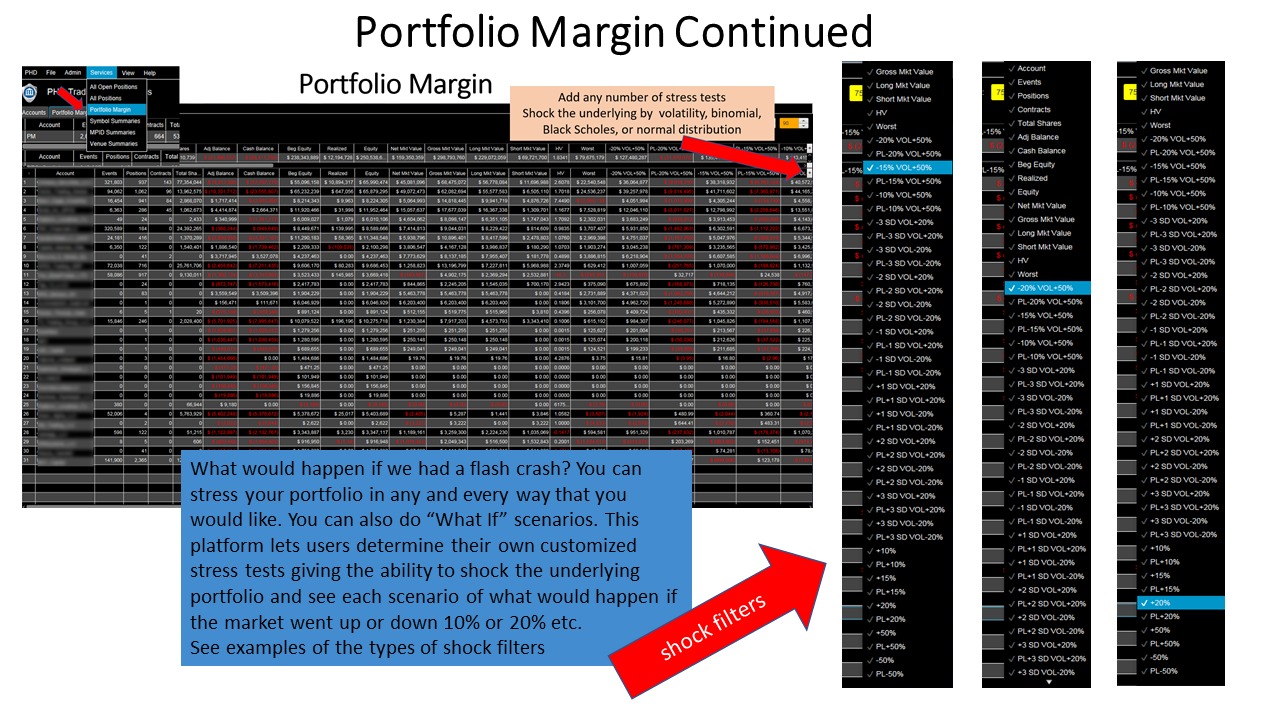

- Monitor Unrealized/Realized Profit/Loss

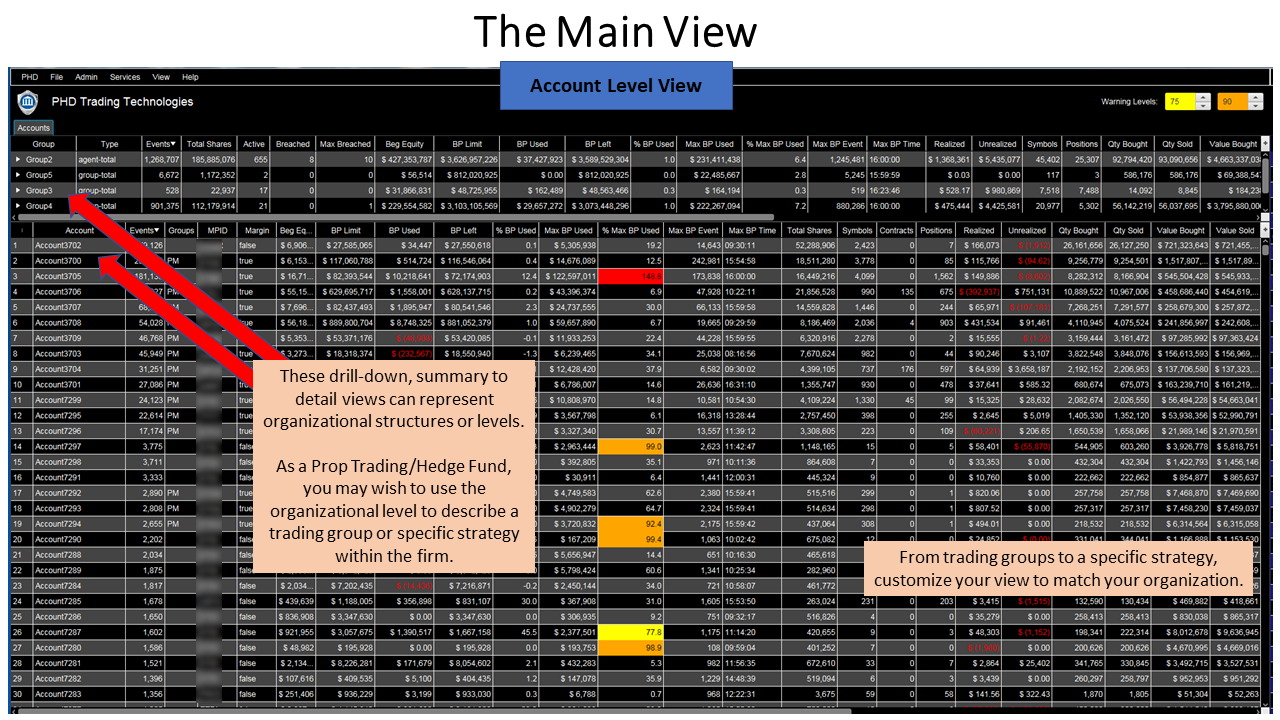

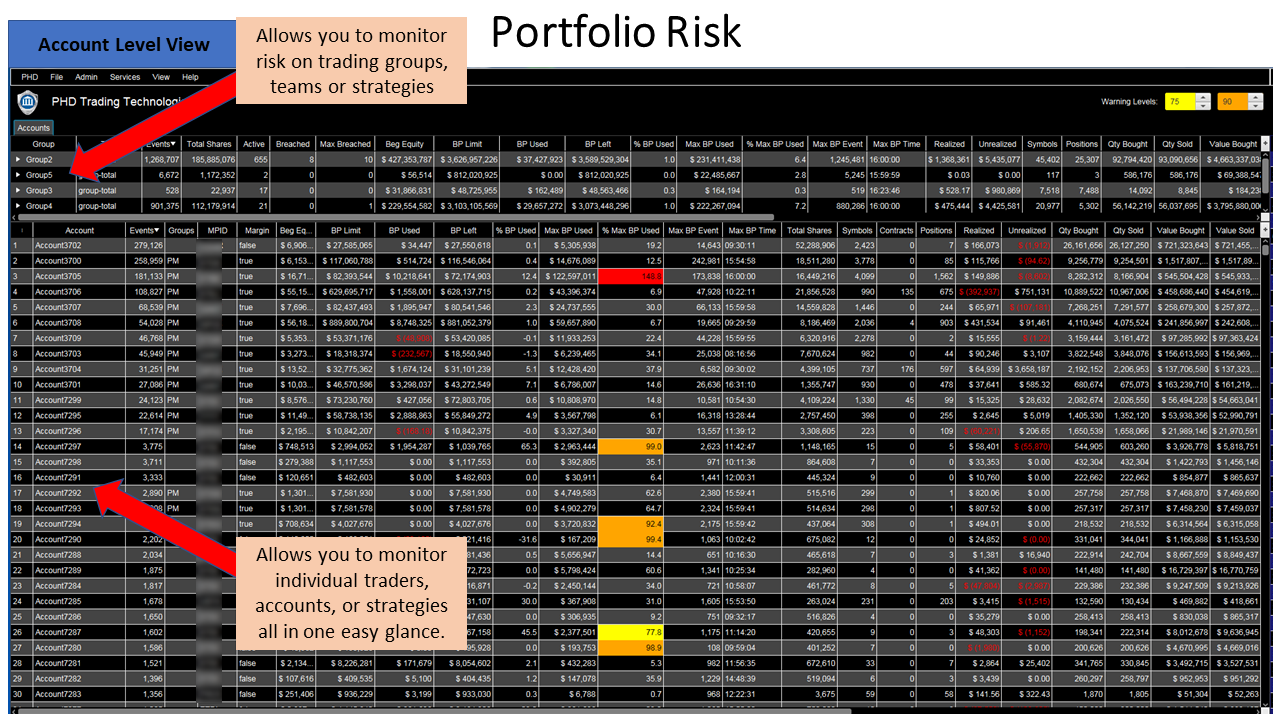

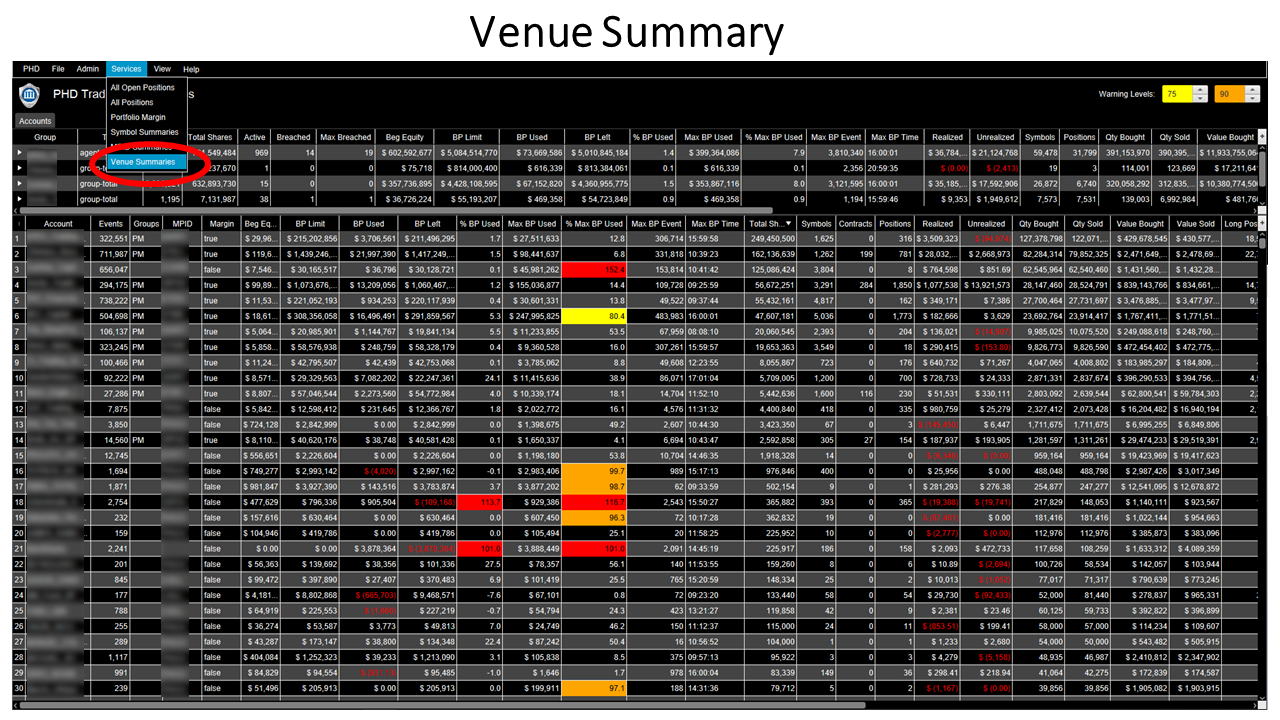

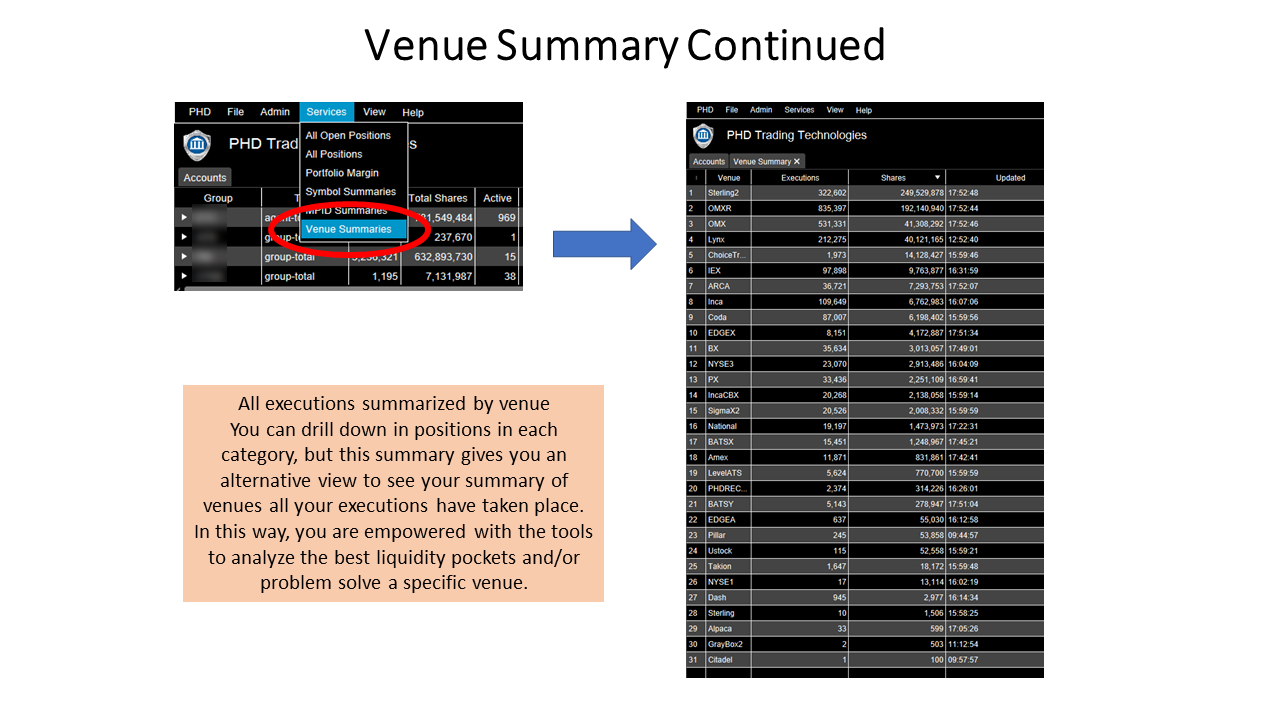

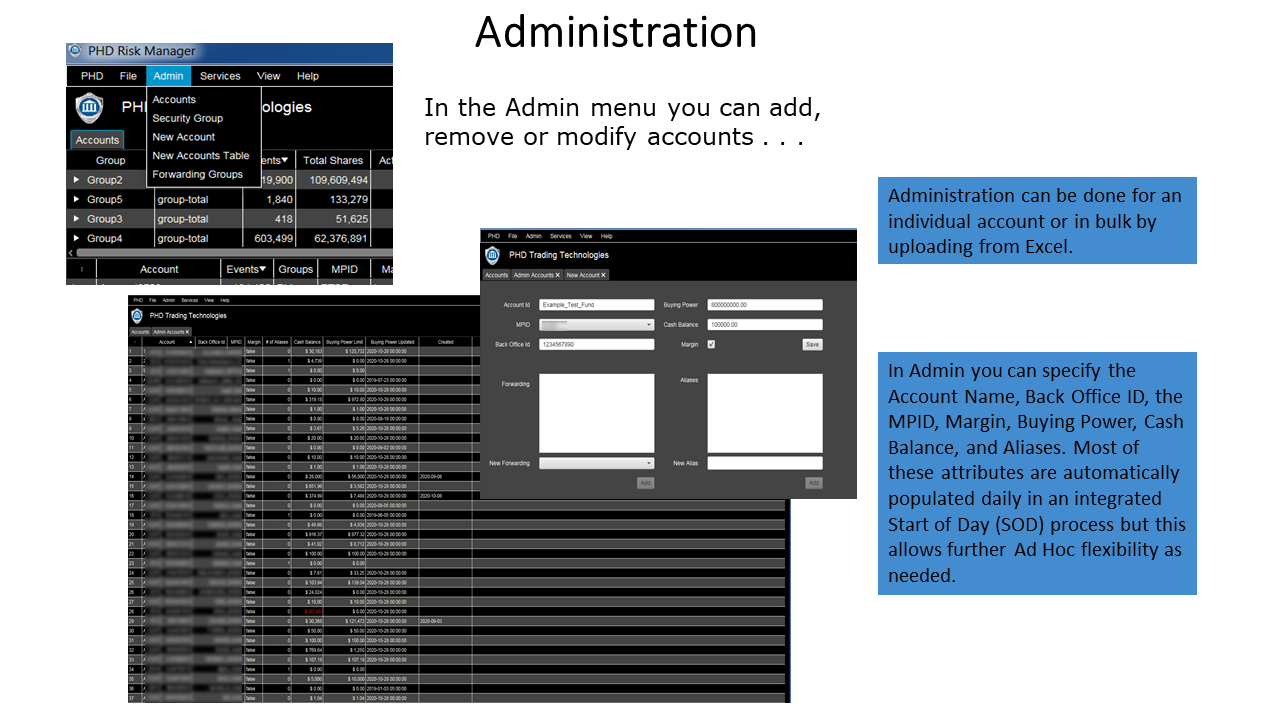

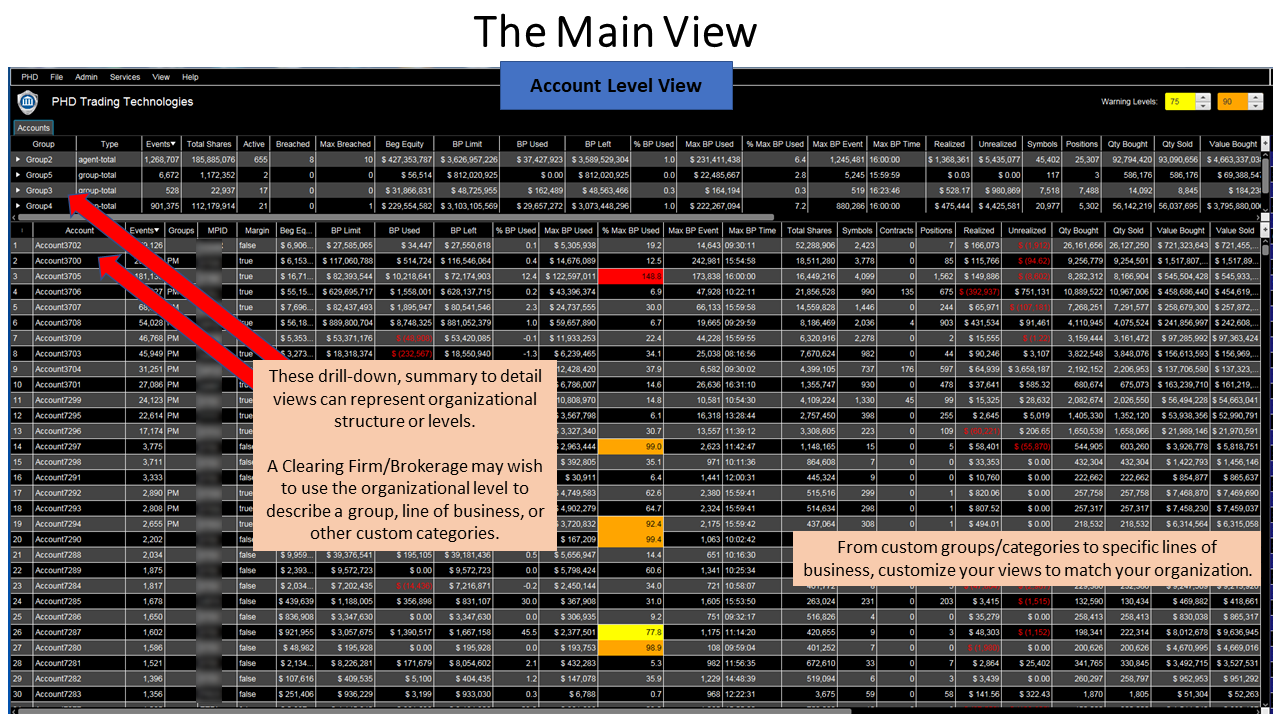

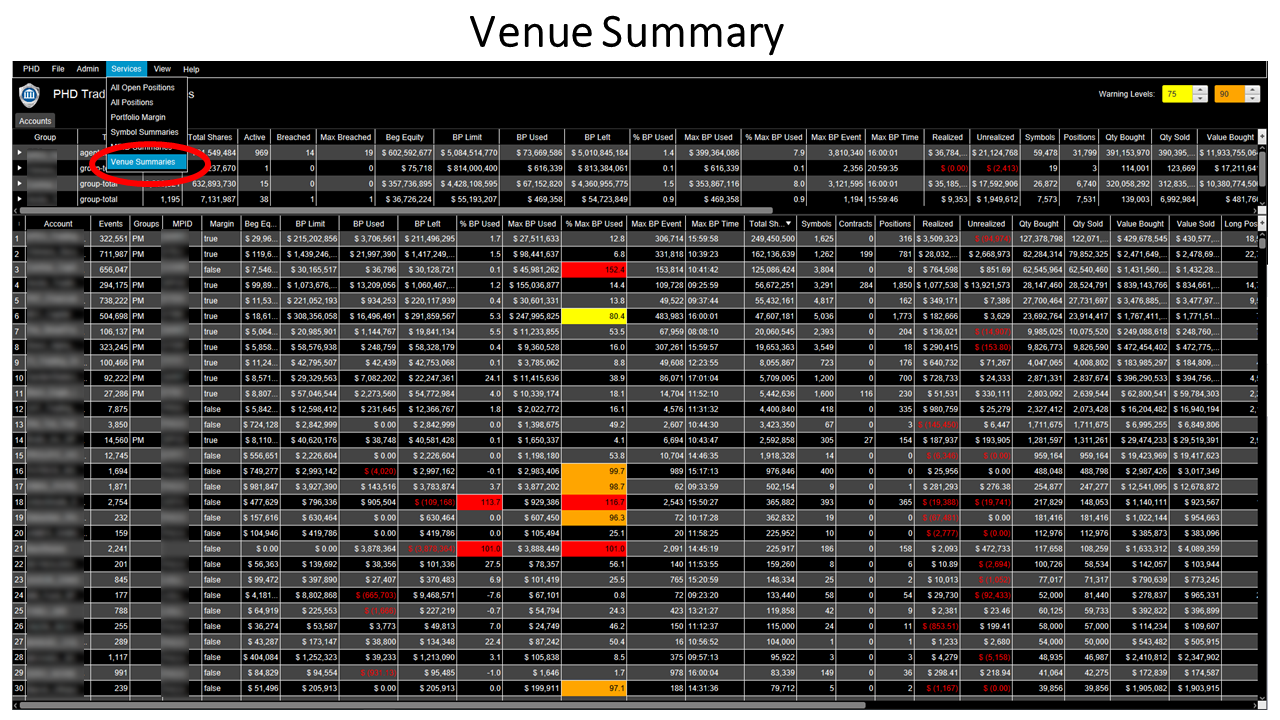

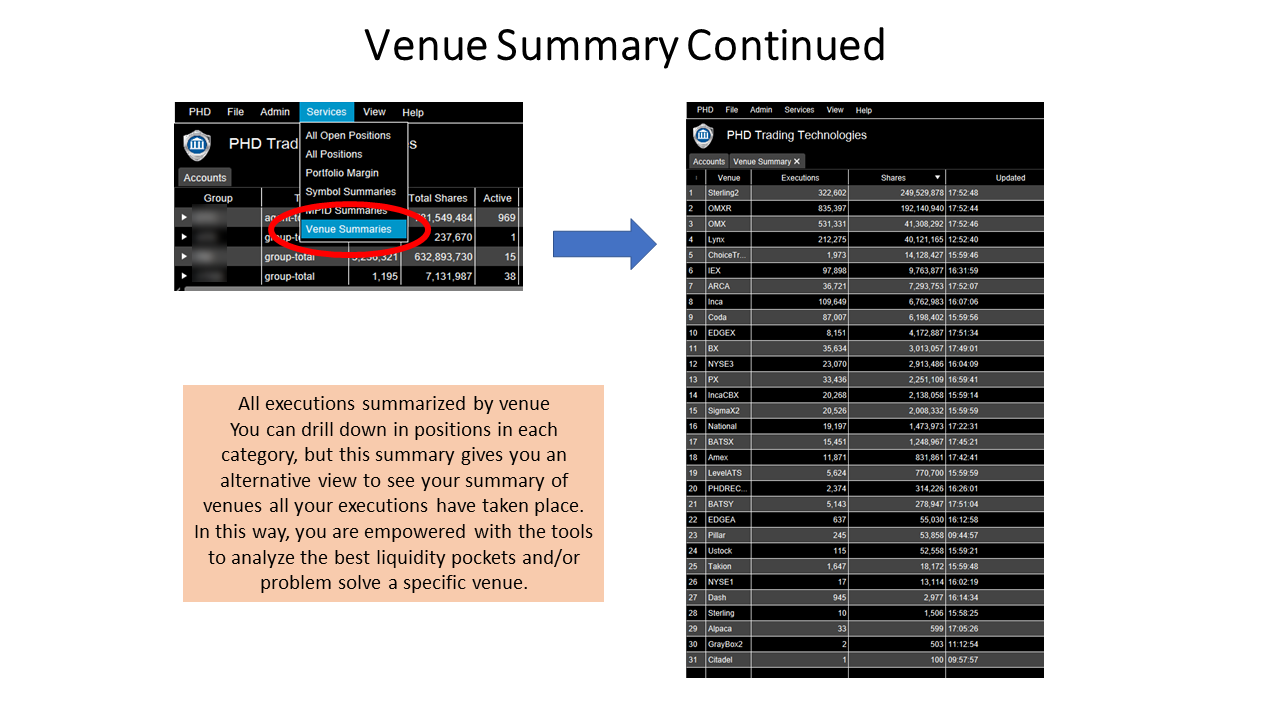

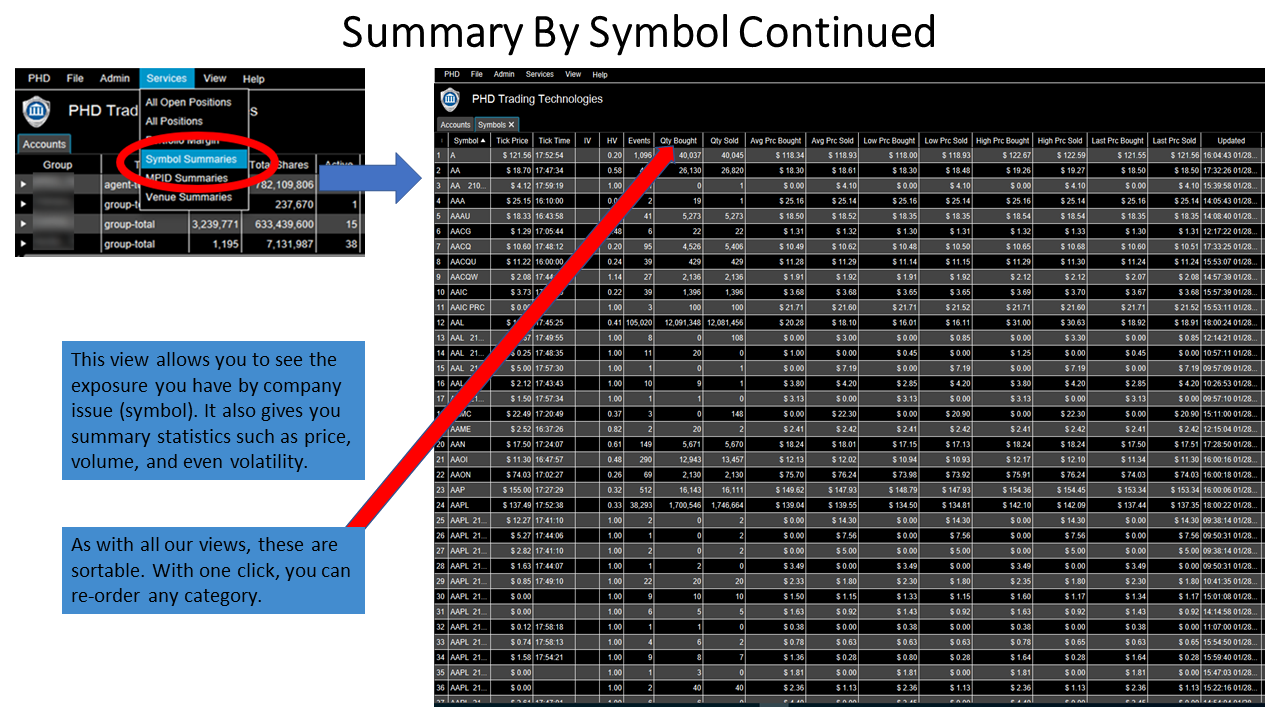

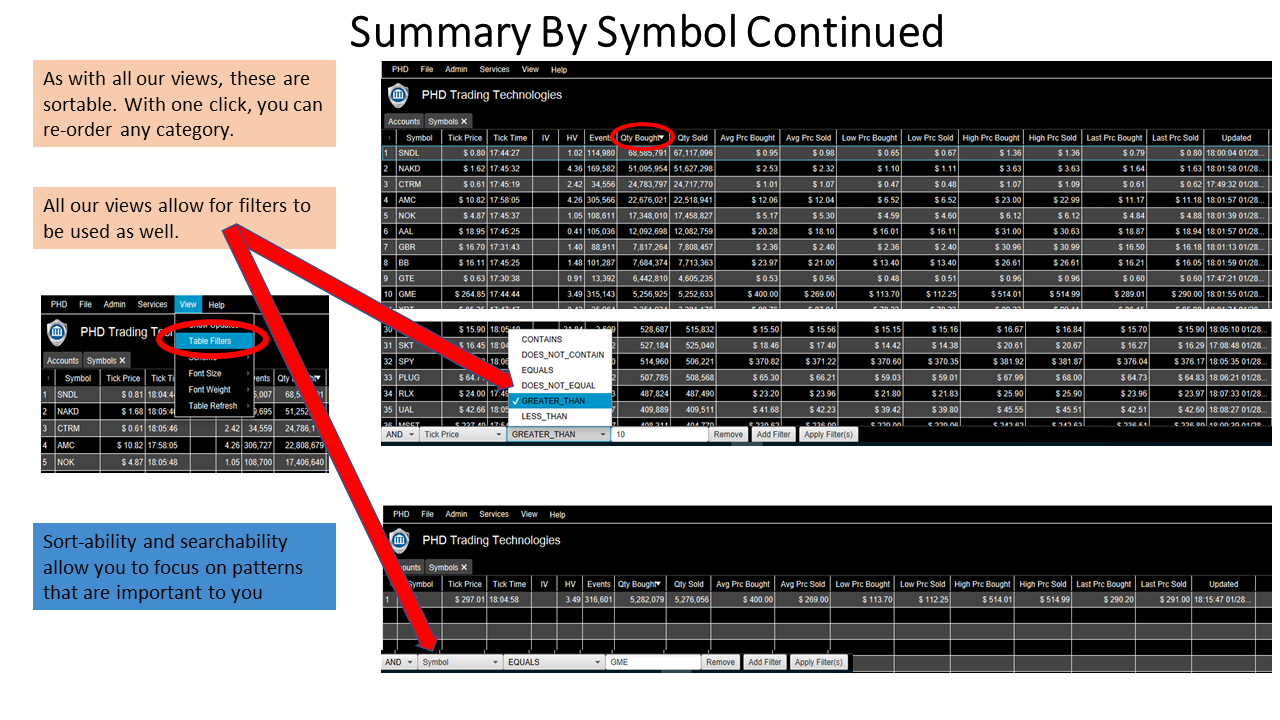

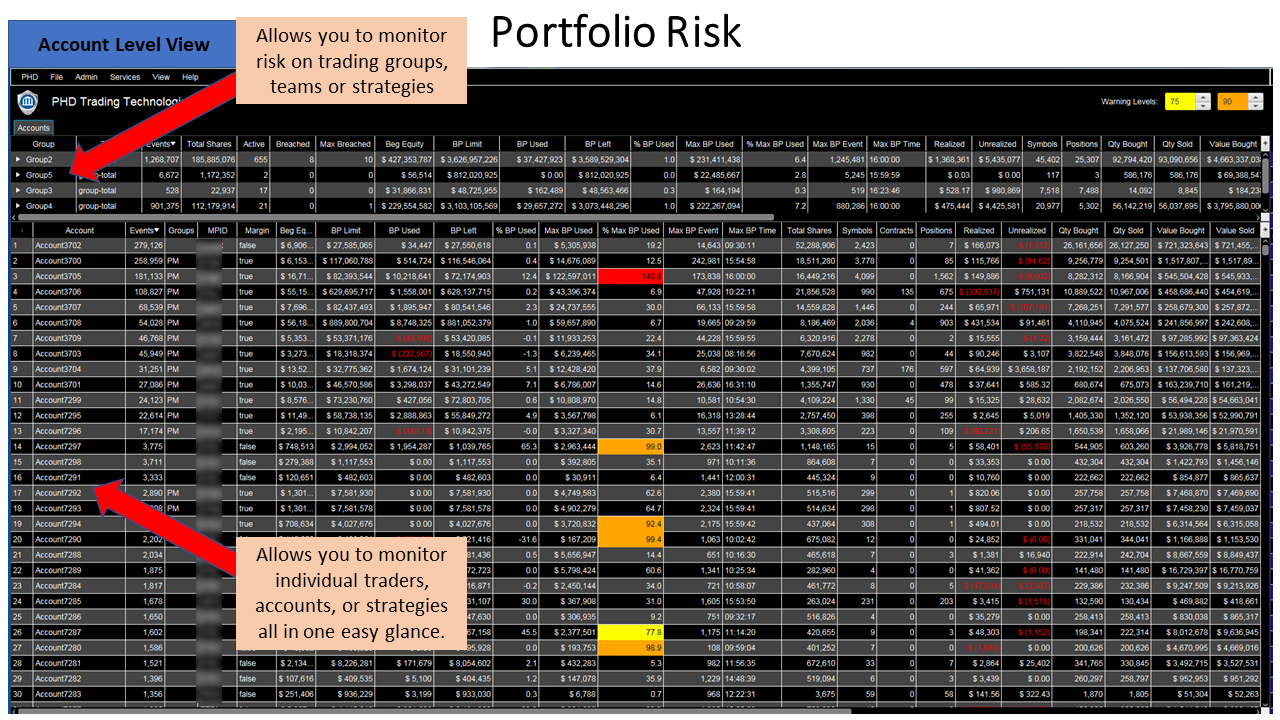

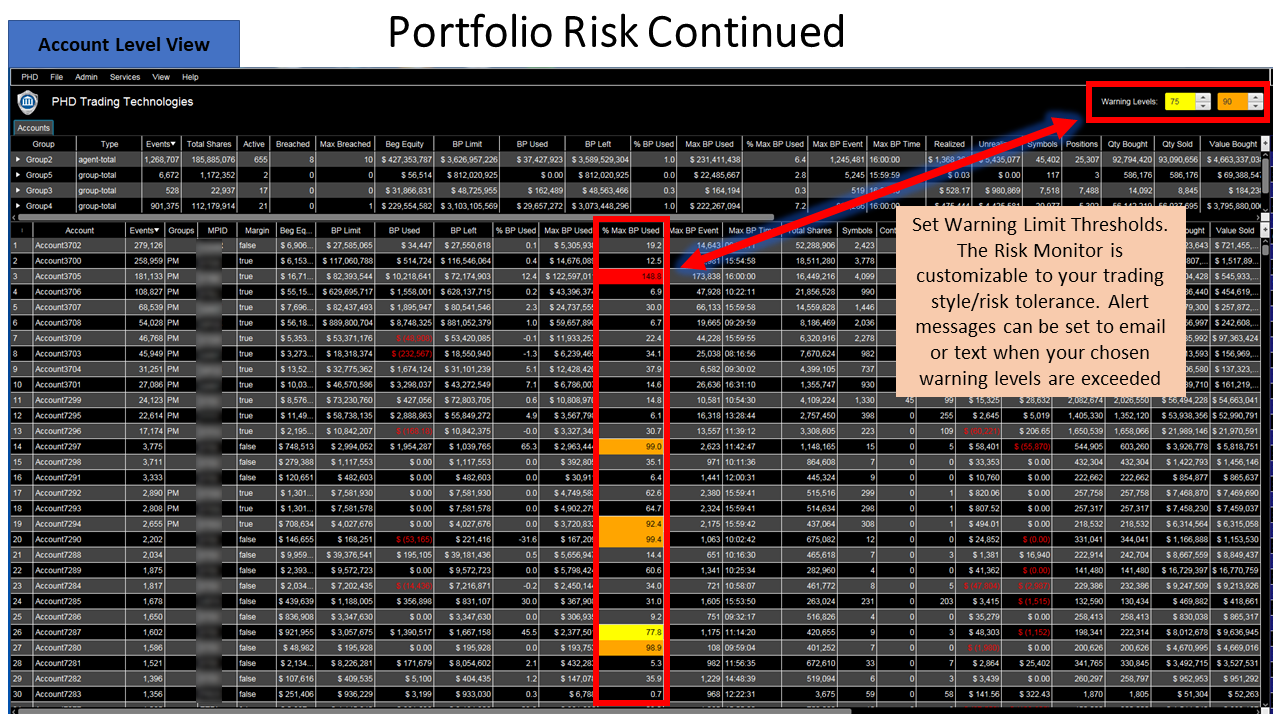

- Manage Risk Across Multiple Accounts

- Map into Organizational Groups that Match Business Needs

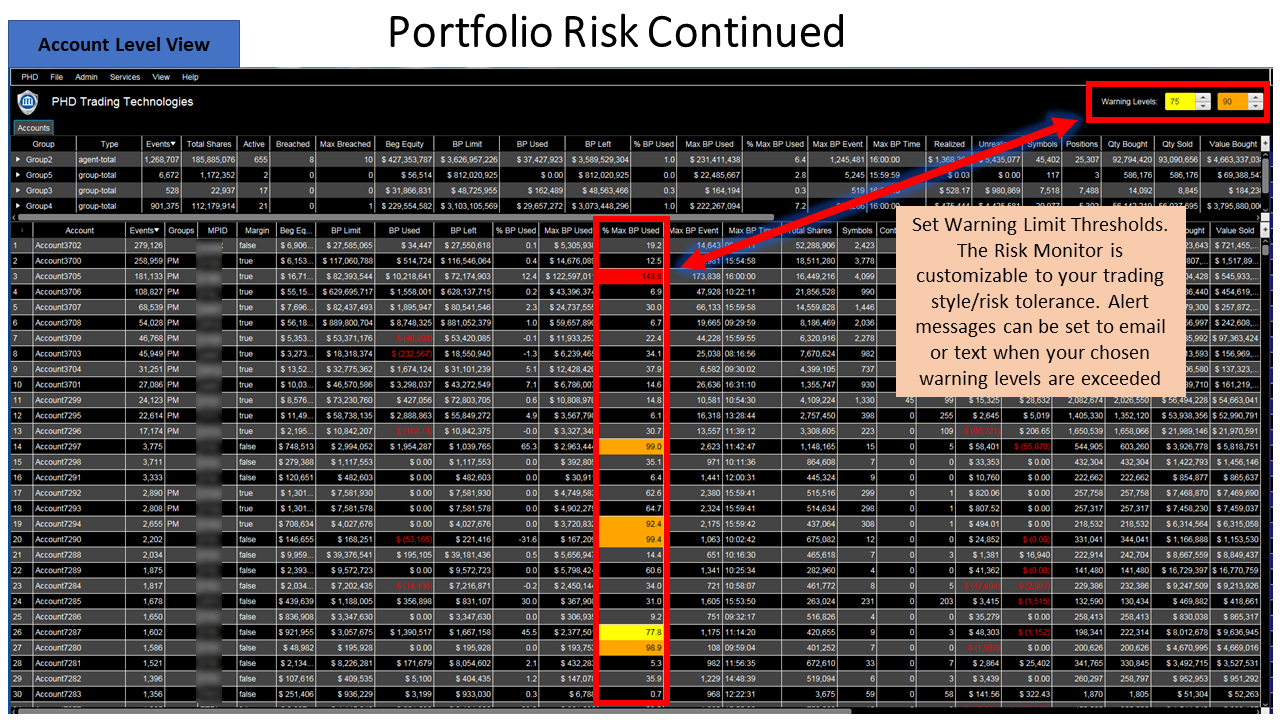

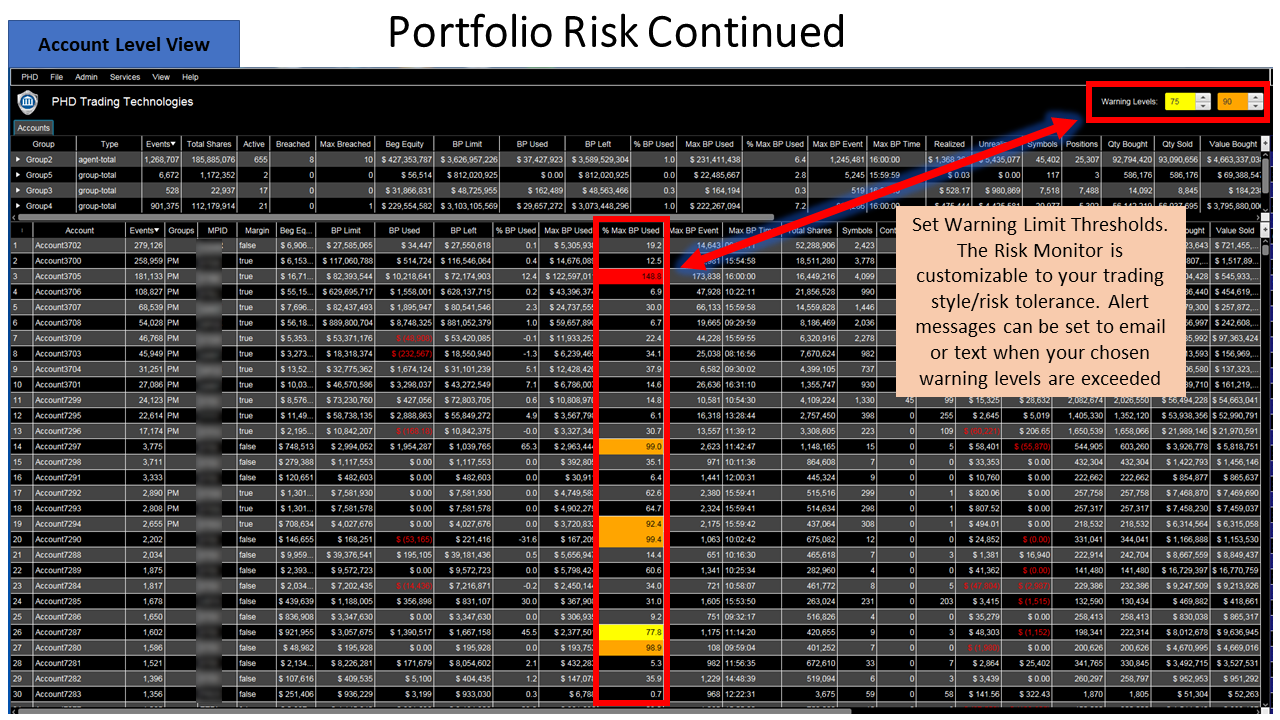

- Set/Manage Trading Limits, Buying Power & Alerts

- Set Automated Trading Limits on Supervised Accounts

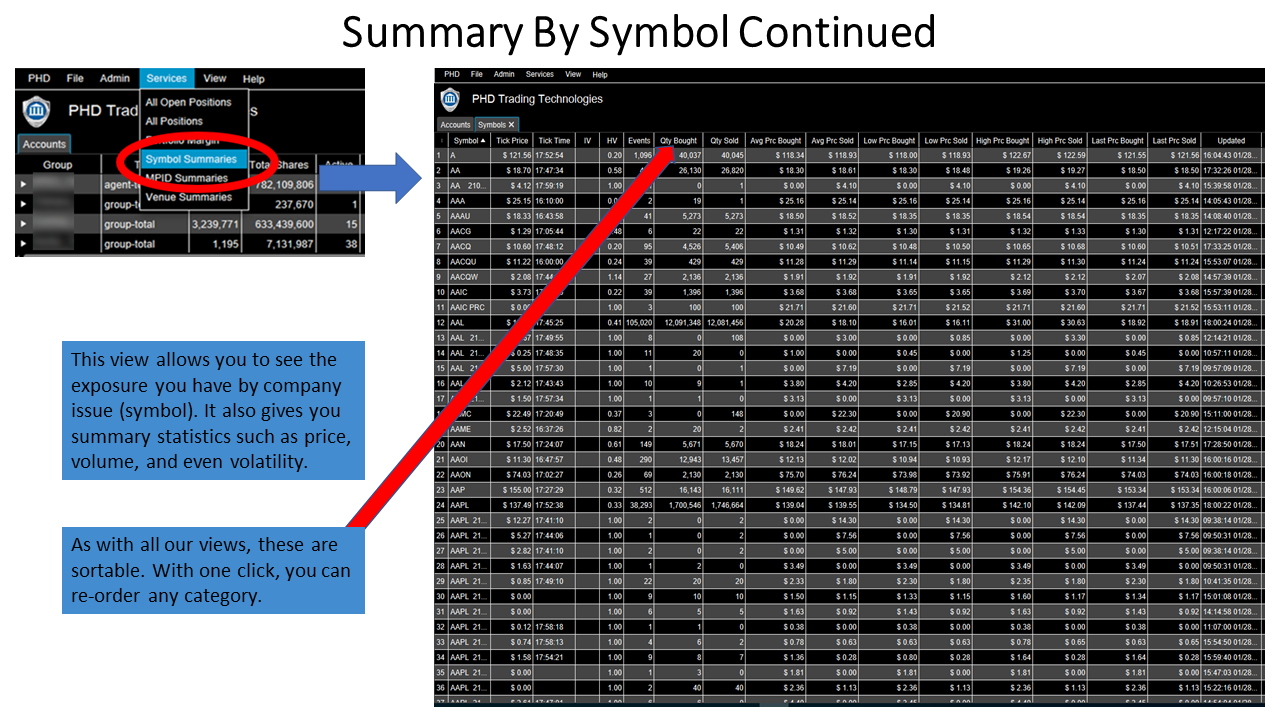

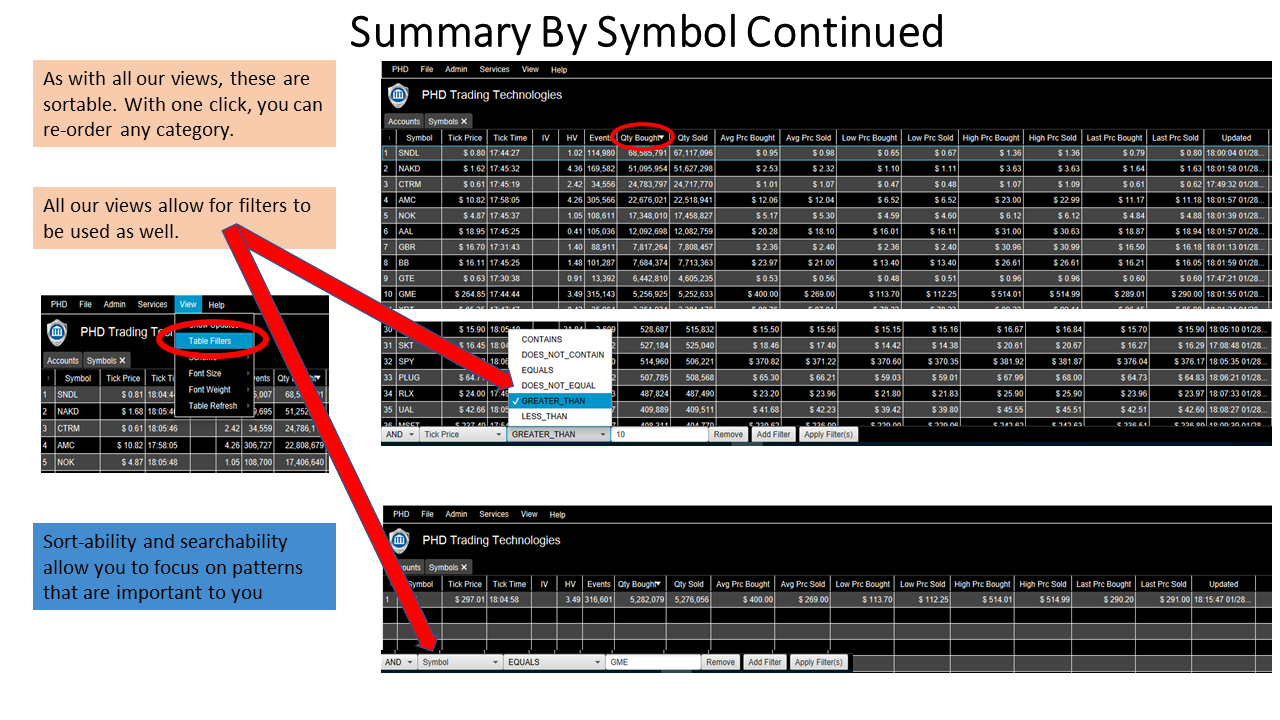

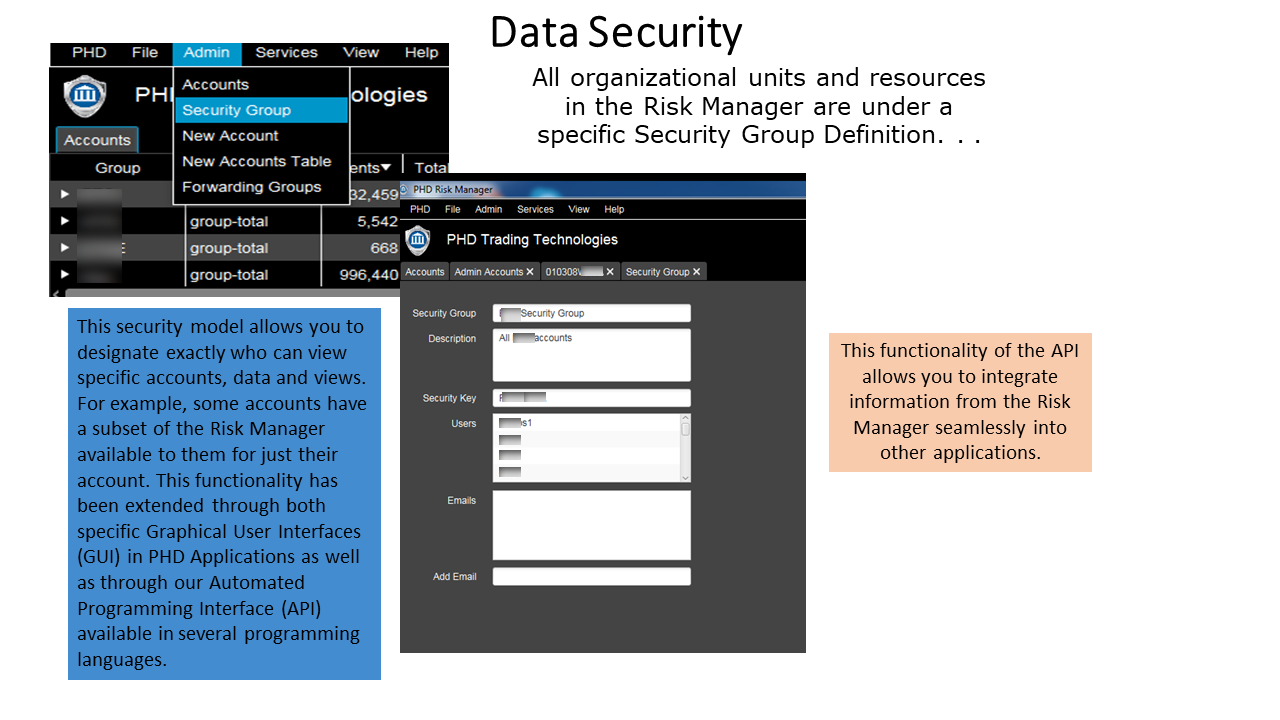

Customizable Client View to Extend Risk Shield (symbol) Benefits to Your Customer

Access Real-Time Short Locate Automated System with Electronic Requests that are Regulatory Compliant

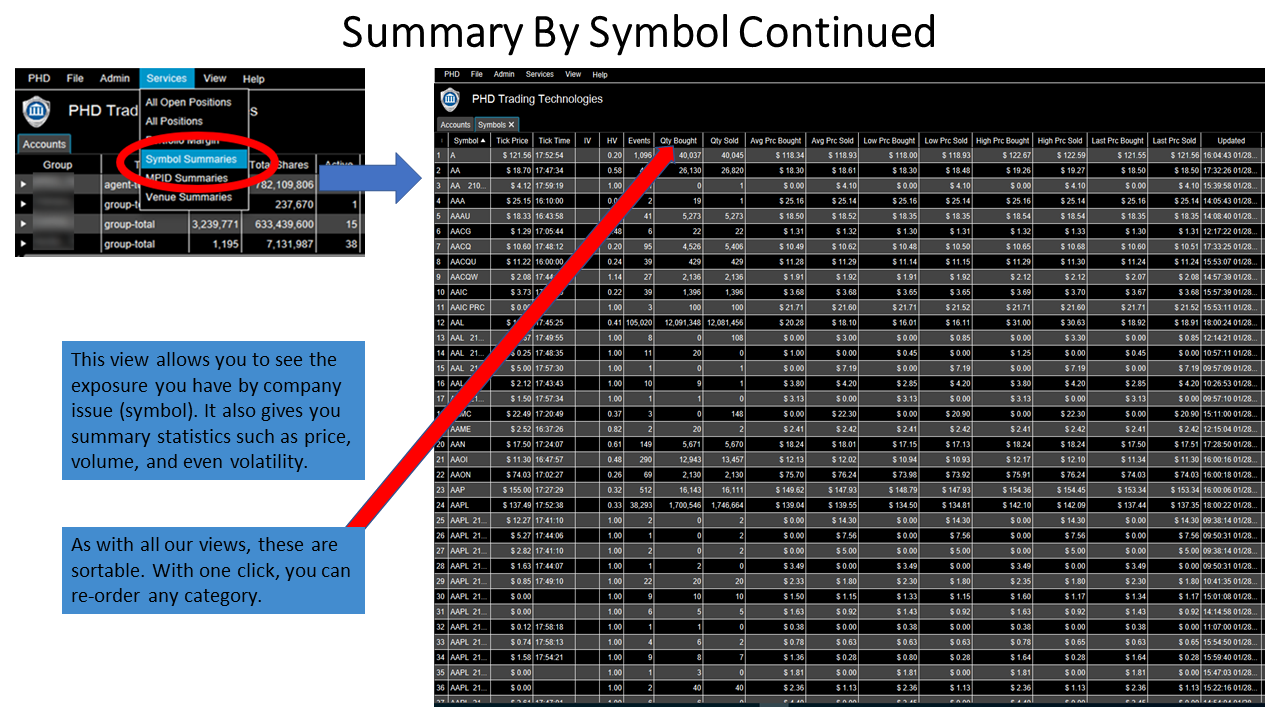

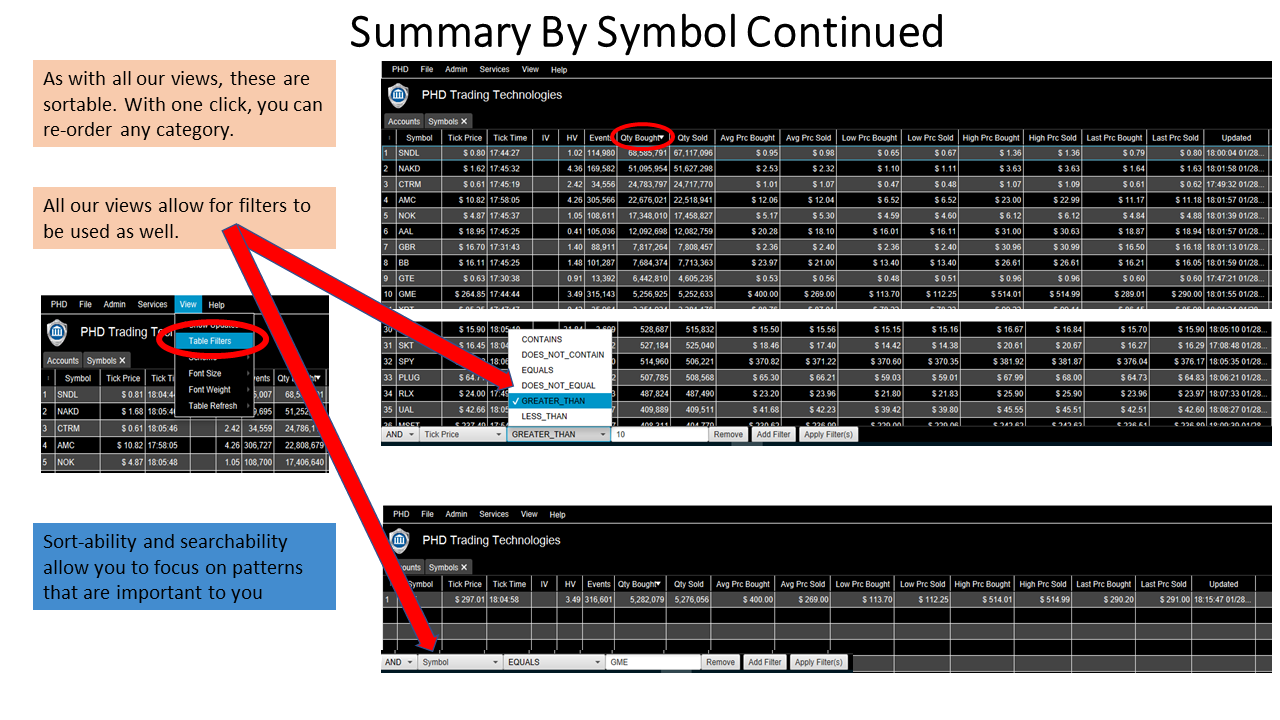

Symbol Monitoring

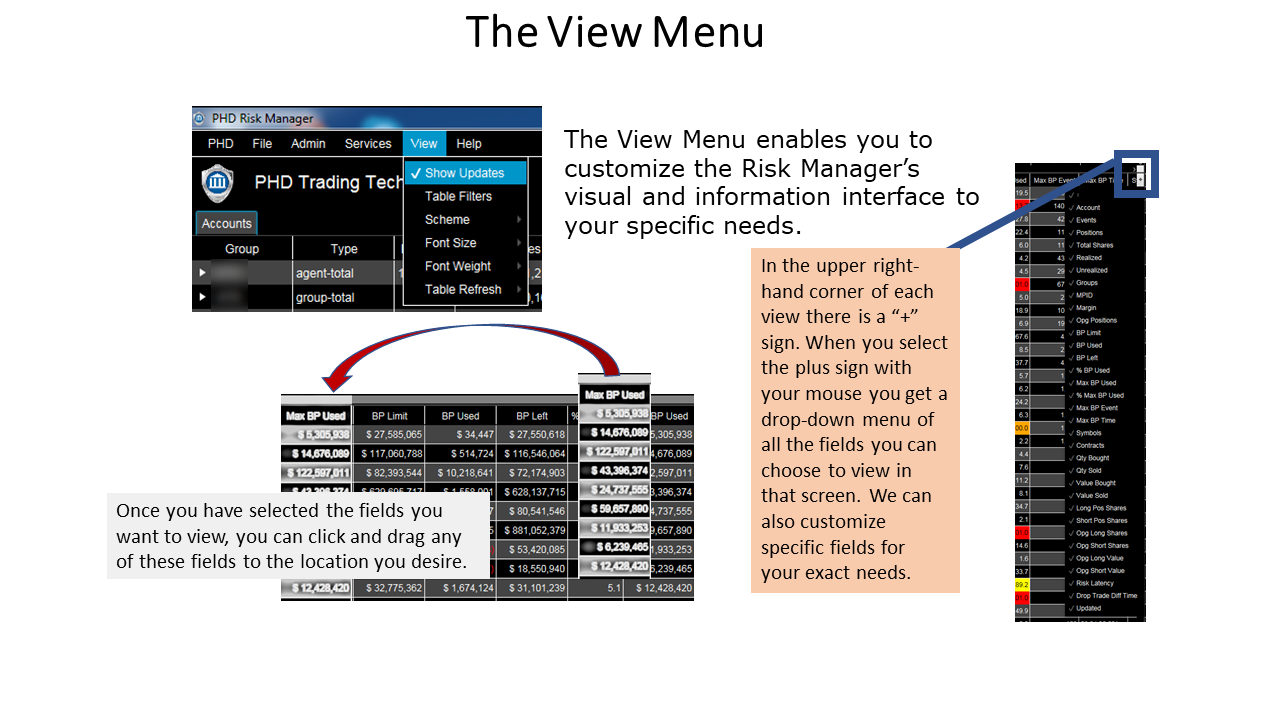

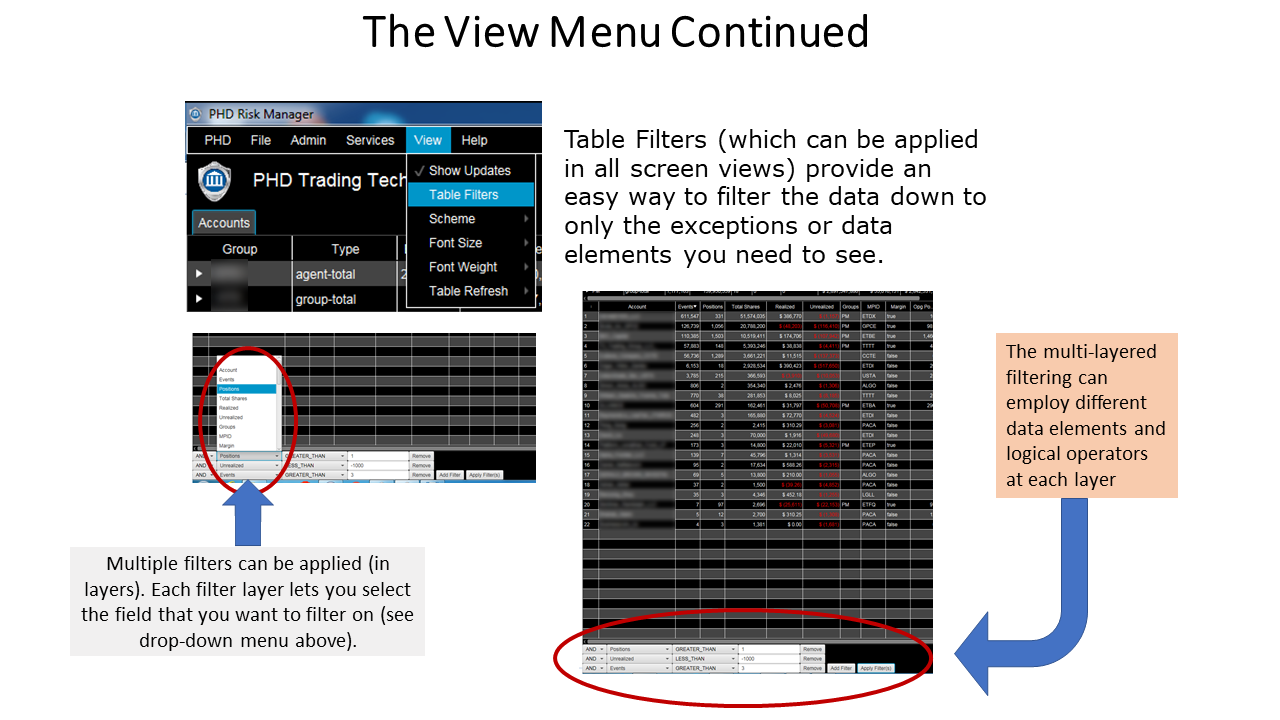

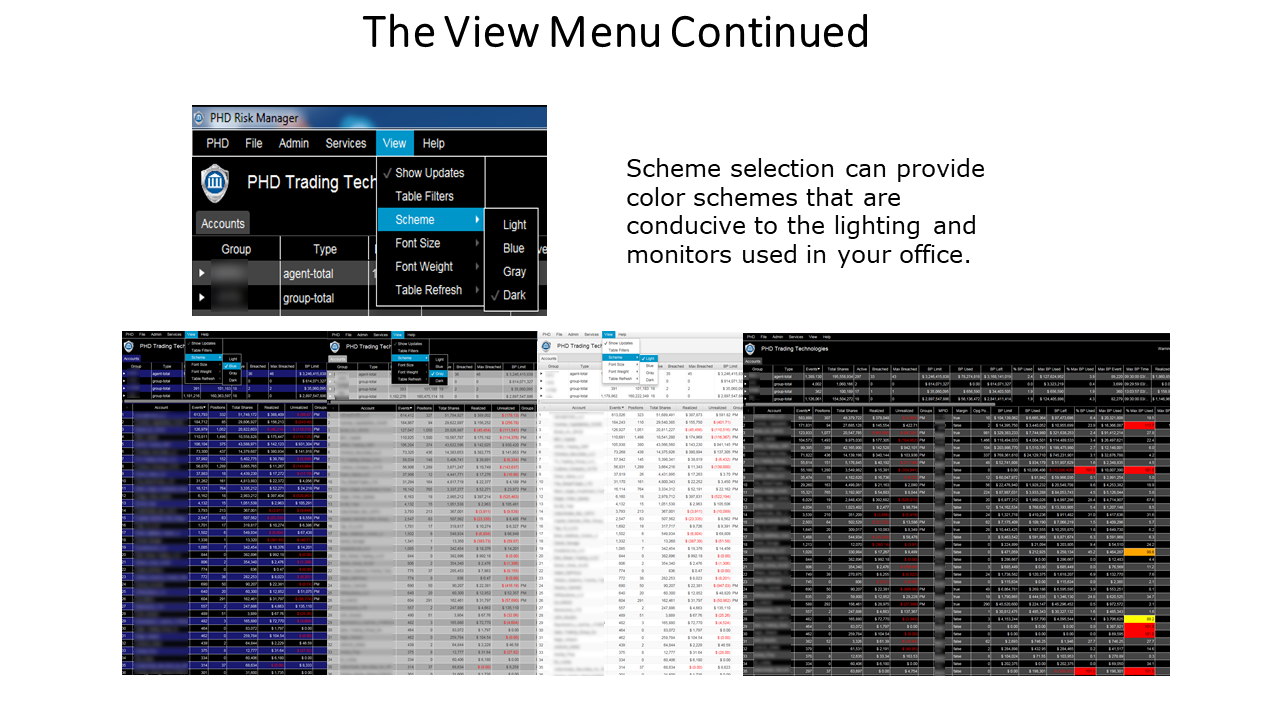

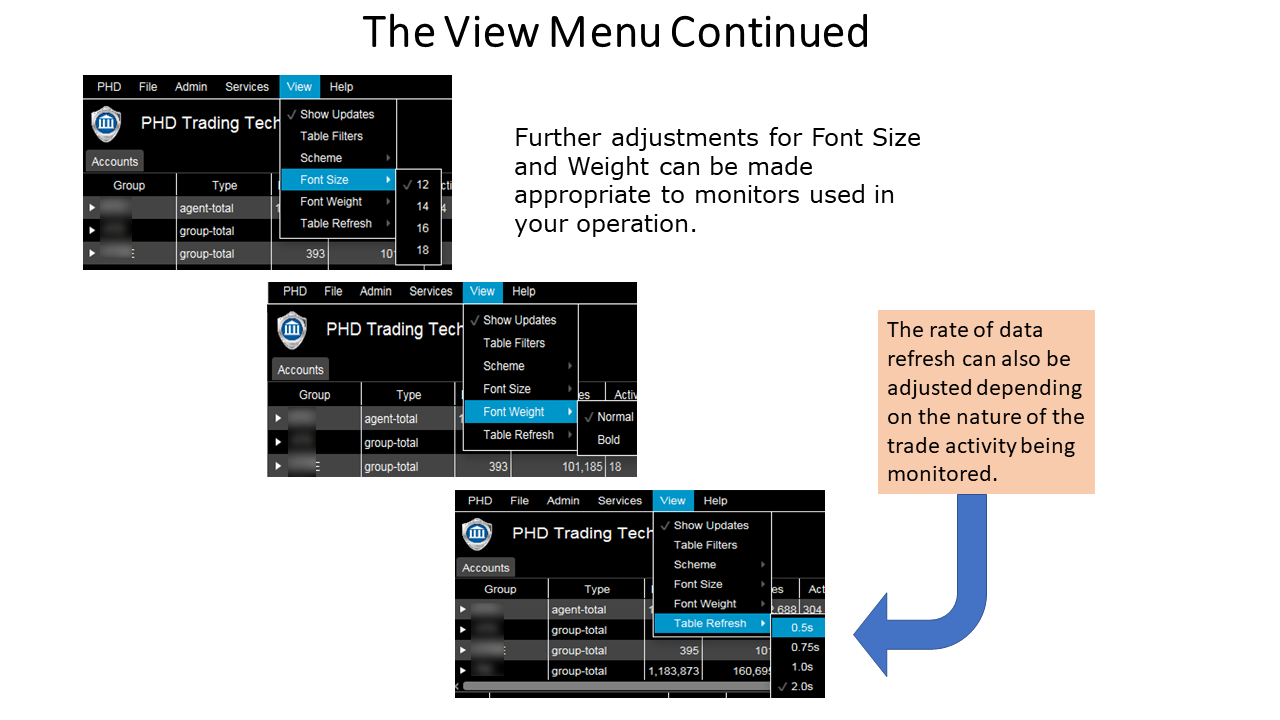

Completely Customizable Risk Solutions

Monitor Exchange Events

- Halted Trading

- IPO Offerings

- Corporate Actions

- Holiday Schedules

- Circuit Breakers